Tuesday, September 30, 2008

OK, Let Me Get This Straight

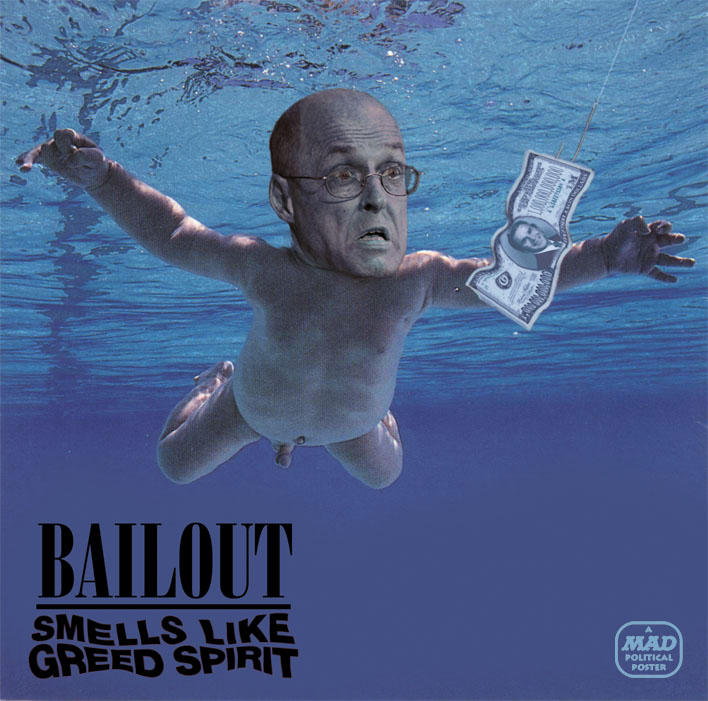

Our government wants $700 billion to basically bail out the five major banks remaining that have volatile portfolios, while the Fed has spewed $650 Billion in inflationary cash into the global markets on top of that, and yet the people who got bagged into bad mortgages and loans and the people in general can't be afforded a single thing?

There hasn't been one official word from anyone about helping the victims of this crisis - the talk of keeping the taxpayers in mind when it comes to the bailout is all about attempting to minimize our risk in giving the banks our money, not in getting anything for ourselves.

No money, no relief, no programs, no assistance. No infrastructure, no energy, no transportation, no health care, no education programs, no anything. $1.3 Trillion created out of the ether after years of claiming poverty and yet none of it benefits any of us. Instead, if we're lucky, we might get some of it back so it can go back to not being used to fix things.

No respect. I've said it before - the individual consumer has no place in the American government anymore - only the dollar and the corporation matter.

There hasn't been one official word from anyone about helping the victims of this crisis - the talk of keeping the taxpayers in mind when it comes to the bailout is all about attempting to minimize our risk in giving the banks our money, not in getting anything for ourselves.

No money, no relief, no programs, no assistance. No infrastructure, no energy, no transportation, no health care, no education programs, no anything. $1.3 Trillion created out of the ether after years of claiming poverty and yet none of it benefits any of us. Instead, if we're lucky, we might get some of it back so it can go back to not being used to fix things.

No respect. I've said it before - the individual consumer has no place in the American government anymore - only the dollar and the corporation matter.

Monday, September 29, 2008

Bottom Line

Joseph Stiglitz, in The Nation...

The administration is once again holding a gun at our head, saying, "My way or the highway." We have been bamboozled before by this tactic. We should not let it happen to us again. There are alternatives. Warren Buffet showed the way, in providing equity to Goldman Sachs. The Scandinavian countries showed the way, almost two decades ago. By issuing preferred shares with warrants (options), one reduces the public's downside risk and insures that they participate in some of the upside potential. This approach is not only proven, it provides both incentives and wherewithal to resume lending. It furthermore avoids the hopeless task of trying to value millions of complex mortgages and even more complex products in which they are embedded, and it deals with the "lemons" problem--the government getting stuck with the worst or most overpriced assets.

...

If we design the right bailout, it won't lead to an increase in our long-term debt--we might even make a profit. But if we implement the wrong strategy, there is a serious risk that our national debt--already overburdened from a failed war and eight years of fiscal profligacy--will soar, and future living standards will be compromised. The president seemed to think that his new shell game will arrest the decline in house prices, and we won't be faced holding a lot of bad mortgages. I hope he's right, but I wouldn't count on it: it's not what most housing experts say. The president's economic credentials are hardly stellar. Our national debt has already climbed from $5.7 trillion to over $9 trillion in eight years, and the deficits for 2008 and 2009--not including the bailouts--are expected to reach new heights. There is no such thing as a free war--and no such thing as a free bailout. The bill will be paid, in one way or another.

Quote O' The Day

The pattern here is perfectly clear. McCain has contempt for anybody who stands between him and the presidency. McCain views himself as the ultimate patriot. He loves his country so much that he cannot let it fall into the hands of an unworthy rival. (They all turn out to be unworthy.) Viewed in this way, doing whatever it takes to win is not an act of selfishness but an act of patriotism. McCain tells lies every day and authorizes lying on his behalf, and he probably knows it. But I would guess--and, again, guessing is all we can do--that in his mind he is acting honorably. As he might put it, there is a bigger truth out there.

-- Jonathan Chait, The New Republic

Intercepted

Wachovia was about to hit the WaMu, only to be saved by a purchase agreement with Citigroup for $1 per share...

Uh huh.

“Wachovia did not fail,” the F.D.I.C. said, “rather it is to be acquired by Citigroup Inc. on an open-bank basis with assistance from the F.D.I.C.”

Uh huh.

Sunday, September 28, 2008

Follow The Money

Josh Marshall finds more money connection between the McCain campaign and Rick Davis' companies,including a $3 million retainer for a web design company that doesn't seem to do anything.

Saturday, September 27, 2008

Dumb Thought

Tina Fey's impression of Sarah Palin, phonetically, is basically Dana Carvey's impression of Walter Mondale.

Quote O' The Day

Rolling Stone's Matt Taibbi, in the not-yet online October 2nd issue, on Palin..

(Jazz From Hell)

"Here's the thing about Americans. You can send their kids off by the thousands to get their balls blown off in foreign lands for no reason at all, saddle them with billions in debt year after congressional year while they spend their winters cheerfully watching game shows and football, pull the rug out from under their mortgages, and leave them living off their credit cards and their Wal-Mart salaries while you move their jobs to China and Bangalore.

"And none of it matters, so long as you remember a few months before Election Day to offer them a two-bit caricature culled from some cutting-room-floor episode of Roseanne as part of your presidential ticket. And if she's a good enough likeness of a loudmouthed Middle American archetype, as Sarah Palin is, John Q. Public will drop his giant sized bag of Doritos in gratitude, wipe the sizzlin' picante dust from his lips and rush to the booth to vote for her. Not because it makes sense, or because it has a chance of improving his life or anyone else's, but simply because it appeals to the low-humming narcissism that substitutes for his personality, because that image on TV reminds him of the mean brainless slob he sees in the mirror every morning.

"Sarah Palin is a symbol of everything that is wrong with the modern United States. As a representative of our political system, she's a new low in reptilian villainy, the ultimate cynical masterwork of puppeteers like Karl Rove. But more than that, she is a horrifying symbol of how little we ask for in return for the total surrender of our political power. Not only is Sarah Palin a fraud, she's the tawdriest, most half-assed fraud imaginable, 20 floors below the lowest common denominator, a character too dumb even for daytime TV – and this country is going to eat her up, cheering every step of the way. All because most Americans no longer have the energy to do anything but lie back and allow ourselves to be jacked off by the calculating thieves who run this grasping consumer paradise we call a nation."

(Jazz From Hell)

Something To Look Forward To

Its becoming pretty clear that, as the American banking sector prepares for the unlikely event of a water landing and the dollar becomes mostly dead, financial officials in other countries are pretty well convinced that the US is not long from ceasing to be a major player at all in international economics, let alone a superpower.

The big sacrifice from a political standpoint may end up being influence. Countries on the Euro and major players like China have isolated themselves fairly effectively from the plummet of our system and the nosedive of the dollar by minding their own business, in every sense of the term.

The big sacrifice from a political standpoint may end up being influence. Countries on the Euro and major players like China have isolated themselves fairly effectively from the plummet of our system and the nosedive of the dollar by minding their own business, in every sense of the term.

West Winging It

Josh is right - this Weisman article on McCain's march on Washington is a fascinating read...

And kudos to the Dems for actually executing a plan.. its been a while.

And kudos to the Dems for actually executing a plan.. its been a while.

One Republican in the room said it was clear that the Democrats came into the meeting with a "game plan" aimed at forcing McCain to choose between the administration and House Republicans. "They had taken McCain's request for a meeting and trumped it," said this source.

Friday, September 26, 2008

Beat The Crowd

Stay Classy, DPD..

The front of the black shirt shows the number "68" with a slash through it. One of the primary protest groups at last month's DNC in Denver called themselves "Recreate 68," harkening back to the violent, 1968 political convention in Chicago.

The back of the shirt features a menacing-looking police figure, wearing what looks like a Denver police badge and helmet and clutching a baton. He's looming over the city of Denver along with the slogan, "WE GET UP EARLY, to BEAT the crowds." Also written across the back of the shirt is "2008 DNC.'

...

"I want an answer," (Seth) Barnett wrote, "of why they take the harm of our citizens and guests as a joke." He said he thinks the shirts are a poor representation of the city and its police force.

There were 154 protestors arrested during the August convention; many taken into custody following a Monday night melee with police along 15th Street.

The Denver police detective who produced the shirts, Det. Nick Rogers, says he has received no complaints until now. He said the shirts are being sold for $10 each at the Police Protective Association Offices.

...

He said the PPA will likely sell a couple thousand of the shirts. They went on sale following the convention and he said every Denver police officer was given one free. Beyond that, he said officers from other departments like Lakewood police and the Jefferson County Sheriffs Department have been clamoring for the shirts and have ordered dozens more. He said after the initial printing, there was so much demand he had to reorder more shirts.

Thursday, September 25, 2008

Recreate '68?

Uh... why is the Army assigning an entire brigade to domestic assignment, including training for non-lethal engagement?

As Greenwald mentions in Update II, it reeks of bad precedent, first and foremost.

As Greenwald mentions in Update II, it reeks of bad precedent, first and foremost.

Disembodied Heads

Your favorite heads on what the hell they think McCain is trying to accomplish with all that suspension crap..

Pants Afire

Newsweek's Michael Isikoff is pretty damn sure Rick Davis is still on the books at Davis Manafort despite myriad statements to the contrary by McCain heads.

Meanwhile, McCain is trying to use the dire emergency to shitcan the first scheduled debate, a laughable ploy Obama is having no part of.

Stirling Newberry, who can be found on several collective blogs as an economic expert, sums up the road to here over at Firedoglake.

Meanwhile, McCain is trying to use the dire emergency to shitcan the first scheduled debate, a laughable ploy Obama is having no part of.

Stirling Newberry, who can be found on several collective blogs as an economic expert, sums up the road to here over at Firedoglake.

Wednesday, September 24, 2008

Deep Thought

A platform republican who wasn't buried in lies and scandal and who actually truly and honestly ran on core republican values of fiscal conservativism and smaller government without waving Jebus and reproductive and marriage rights in my face could probably have my vote this year. If there were such a thing.

Ed Stein

Too True

Ed Stein Rocky Mountain News Sep 24, 2008 |

Dave!

from Drudge, who doesn't really need to be linked..

EXCLUSIVE: LETTERMAN MOCKS MCCAIN CANCELLATION

Wed Sep 24 2008 17:41:58 ET

David Letterman tells audience that McCain called him today to tell him he had to rush back to DC to deal with the economy.

Then in the middle of the taping Dave got word that McCain was, in fact just down the street being interviewed by Katie Couric. Dave even cut over to the live video of the interview, and said, "Hey Senator, can I give you a ride home?"

Earlier in the show, Dave kept saying, "You don't suspend your campaign. This doesn't smell right. This isn't the way a tested hero behaves." And he joked: "I think someone's putting something in his metamucil."

"He can't run the campaign because the economy is cratering? Fine, put in your second string quarterback, Sara Palin. Where is she?"

"What are you going to do if you're elected and things get tough? Suspend being president? We've got a guy like that now!"

The Reanimator

Looks like lipstick on a pig runs around $5 grand..

Tuesday, September 23, 2008

There Is No 'Crisis'...

... just a heist. A few questions need to be answered before anybody gives anyone anything..

Sunday, September 21, 2008

I Love Athenae

A. gets right to the outrage part..

Where was our country when our countrymen needed it most?

Where was the state of emergency, now occurring because the economy is melting from the top down, when it was crumbling from the bottom up?

Where were the demands we shove $700 billion into rebuilding this country, so that people could get to work, so that people could get to school, so that people could live in ways that wouldn't shame us when we were occasionally forced to look ourselves in the face, where was the willingness of Congress to work weekends then?

... it's not that I don't get it. On the contrary. I and most of the rest of America have been getting it for years. Getting it good and hard, in fact, and you couldn't pay anybody currently having a freakout to care.

I Prefer The Word 'Heist'..

..but William Greider is perfectly content with 'swindle'..

Financial-market wise guys, who had been seized with fear, are suddenly drunk with hope. They are rallying explosively because they think they have successfully stampeded Washington into accepting the Wall Street Journal solution to the crisis: dump it all on the taxpayers. That is the meaning of the massive bailout Treasury Secretary Henry Paulson has shopped around Congress. It would relieve the major banks and investment firms of their mountainous rotten assets and make the public swallow their losses--many hundreds of billions, maybe much more. What's not to like if you are a financial titan threatened with extinction?

If Wall Street gets away with this, it will represent an historic swindle of the American public--all sugar for the villains, lasting pain and damage for the victims. My advice to Washington politicians: Stop, take a deep breath and examine what you are being told to do by so-called "responsible opinion." If this deal succeeds, I predict it will become a transforming event in American politics--exposing the deep deformities in our democracy and launching a tidal wave of righteous anger and popular rebellion.

...

If government acts responsibly, it will impose some other conditions on any broad rescue for the bankers. First, take due bills from any financial firms that get to hand off their spoiled assets, that is, a hard contract that repays government from any future profits once the crisis is over. Second, when the politicians get around to reforming financial regulations and dismantling the gimmicks and "too big to fail" institutions, Wall Street firms must be prohibited from exercising their usual manipulations of the political system. Call off their lobbyists, bar them from the bribery disguised as campaign contributions.

...

More important, if the taxpayers are compelled to refinance the villains in this drama, then Americans at large are entitled to equivalent treatment in their crisis. That means the suspension of home foreclosures and personal bankruptcies for debt-soaked families during the duration of this crisis. The debtors will not escape injury and loss--their situation is too dire--but they deserve equal protection from government, the chance to work out things gradually over some years on reasonable terms.

...

The agenda is staggering. The United States is ill equipped to deal with it smartly, not to mention wisely...

Saturday, September 20, 2008

Credit Crunch

A very good NYT article on how the tightening of credit has affected all levels of consumerism from loans to credit cards to classified sales and auctions.

No End In Sight

CalculatedRisk, the site that originally blogged the leaked bailout plan, reacts to the NYT's assertion that taxpayers may profit from the plan at some point.

The referenced section of the plan, verbatim:

The plan only limits the Treasury to "$700,000,000,000 outstanding at any one time", so the total purchases can exceed $700 billion. In fact, every time the Treasury sells some securities, they will probably plow the net proceeds back into more troubled assets until the entire $700 billion is gone.

Think of a drunk gambler at a slot machine. He starts with $100 and slowly loses. Every now and then he wins some money, but he keeps putting the coins back into the slot until he has lost everything. That is how this plan will work.

The referenced section of the plan, verbatim:

Sec. 6. Maximum Amount of Authorized Purchases.

The Secretary’s authority to purchase mortgage-related assets under this Act shall be limited to $700,000,000,000 outstanding at any one time

This Is Not Your Older Brother's Bank Crisis..

Josh Marshall points to The Post's Sebastian Mallaby, who explains why this proposed bailout is entirely different from the S&L crisis process..

In the 1980s, the government did not need a strategy to decide which bad loans to take over; it dealt with anything that fell into its lap as a result of a thrift bankruptcy. But under the current proposal, the government would go out and shop for bad loans. These come in all shapes and sizes, so the government would have to judge what type of loans it wants. They are illiquid, so it's hard to know how to value them. Bad loans are weighing down the financial system precisely because private-sector experts can't determine their worth. The government would have no better handle on the problem.

In practice this means the government would make subjective choices about which bad loans to buy, and it would pay more than fair value. Billions in taxpayer money would be transferred to the shareholders and creditors of banks, and the banks from which the government bought most loans would be subsidized more than their rivals. If the government bought the most from the sickest institutions, it would be slowing the healthy process in which strong players buy up the weak, delaying an eventual recovery. The haggling over which banks got to unload the most would drag on for months. So the hope that this "systematic" plan can be a near-term substitute for ad hoc AIG-style bailouts is illusory.

...

Taking bad loans off the shoulders of the banks seems like a merciful rescue; ordering banks to raise capital or buying equity stakes in them sounds like big-government meddling. But we are in the midst of a crisis, and it shouldn't matter how things sound. The Treasury plan outlined on Friday involves vast risks to taxpayers, huge complexity and no guarantee of success. There are better ways forward.

Liquidity vs. Insolvency

Paul Krugman explains why the blank-check bailout looks more like an end-around than a solution..

I'm no expert, not even close. But if this crisis amounts to throwing money at otherwise technically solvent banks before they fail because they can't generate liquidity, and that phantom liquidity proceeds without reform or regulation and leads to insolvency anyway, then this bailout is just a $700 Billion golden parachute that protects only the ones who created the problem in the first place.

...Historically, financial system rescues have involved seizing the troubled institutions and guaranteeing their debts; only after that did the government try to repackage and sell their assets. The feds took over S&Ls first, protecting their depositors, then transferred their bad assets to the RTC. The Swedes took over troubled banks, again protecting their depositors, before transferring their assets to their equivalent institutions.

The Treasury plan, by contrast, looks like an attempt to restore confidence in the financial system — that is, convince creditors of troubled institutions that everything’s OK — simply by buying assets off these institutions.

...

And there’s no quid pro quo here — nothing that gives taxpayers a stake in the upside, nothing that ensures that the money is used to stabilize the system rather than reward the undeserving.

I'm no expert, not even close. But if this crisis amounts to throwing money at otherwise technically solvent banks before they fail because they can't generate liquidity, and that phantom liquidity proceeds without reform or regulation and leads to insolvency anyway, then this bailout is just a $700 Billion golden parachute that protects only the ones who created the problem in the first place.

Grand Theft treasury

Holy fuck.

Here, give us $700 Billion without us telling you where its going, raise the legal debt ceiling to $11.3 Trillion so we don't have to bitch about it later, and make it so we can't ever talk about or be accountable for the absolute illegality of the whole thing later.

Wow. Balls.

This is, in essence, what the Iraq portion of the War On Terror became: a blatant attempt by BushCo and subsidiaries to redistribute the US Treasury among a few dozen CEO friends. They've lost everything at the poker table, but losing isn't acceptable so they're demanding that the casino repay them what they came in with, plus a little extra for the inconvenience of feeling like a loser for those five excruciating minutes they thought they might leave empty handed.

Sec. 8. Review.

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

Sec. 9. Termination of Authority.

The authorities under this Act, with the exception of authorities granted in sections 2(b)(5), 5 and 7, shall terminate two years from the date of enactment of this Act.

Sec. 10. Increase in Statutory Limit on the Public Debt.

Subsection (b) of section 3101 of title 31, United States Code, is amended by striking out the dollar limitation contained in such subsection and inserting in lieu thereof $11,315,000,000,000.

Here, give us $700 Billion without us telling you where its going, raise the legal debt ceiling to $11.3 Trillion so we don't have to bitch about it later, and make it so we can't ever talk about or be accountable for the absolute illegality of the whole thing later.

Wow. Balls.

This is, in essence, what the Iraq portion of the War On Terror became: a blatant attempt by BushCo and subsidiaries to redistribute the US Treasury among a few dozen CEO friends. They've lost everything at the poker table, but losing isn't acceptable so they're demanding that the casino repay them what they came in with, plus a little extra for the inconvenience of feeling like a loser for those five excruciating minutes they thought they might leave empty handed.

The Annotated Eschaton

klep·toc·ra·cy /[klep-tok-ruh-see] Pronunciation Key –noun, plural ‑cies. a government or state in which those in power exploit national resources and steal; rule by a thief or thieves.

--------------------------------------------------------------------------------

[Origin: 1815–20; klepto- (comb. form of Gk kléptés thief) + -cracy]

—Related forms

klep·to·crat /[klep-tuh-krat] , noun

klep·to·crat·ic /[klep-tuh-krat-ik], adjective

You're welcome.

Friday, September 19, 2008

KO Sums Up Gramps

GET OFF MY LAWN!

"The Presidential candidate said if he were in office now, he'd respond to the financial crisis by firing the chairman of the SEC... evidently not knowing the president can't fire the chairman of the SEC..."

Weekend at Benanke's

Cursor, as usual, tees up the State Of The Shitpile before taking the weekend off. Former TPMer Paul Kiel reviews the unaccountable $800 Billion Man, while Jeffrey Gundlach of TCW Group warns of No Market For Old Men and puts the ugh in ugly along the way...

In the deteriorating climate he sees unfolding, Gundlach said, the Standard & Poor's "This is no market for old-school thinking." Gundlach based his assessment on a belief that housing prices still face several more years of decline, a protracted slump, he said, not seen since the Great Depression. Moreover, Gundlach said it's possible that home prices could be sluggish until 2022.

"If it's like the Depression experience -- and it sure is shaping up that way -- it could take several years. Maybe we won't see a bottom in home prices until 2014," he said.

...

Expect loan default rates to rise, Gundlach said, not just in the subprime market, but among the top-drawer prime borrowers as well. The prime default rate could approach 10% from a current 2% before the carnage is over, he said.

"The current environment is maybe a little worse that what was experienced in the Depression in terms of the housing market," Gundlach said.

Accordingly, financial institutions may suffer write-offs that could surpass $1 trillion before conditions improve, he said. As of late August, credit losses and writedowns at the world's 100-largest banks and brokerages topped $506 billion, he noted.

...

"I would give a very meaningful probability to the biggest, next AIG-size debacle being Citigroup," the strategist said. "I would definitely not be a buyer of Citigroup stock," Gundlach said. "If I were going to buy financial market stocks," he added, "I would be a buyer of Wells Fargo."

Other financial giants also won't escape the crisis unscathed, Gundlach said. "I don't see how Wachovia can make it as a stand alone," he said. He expressed the same sentiment about Morgan Stanley.

Thursday, September 18, 2008

Fukkit. We're Buying EVERYONE Out.

NYT Via Atrios, The Fed is preparing to outright purchase discounted 'distressed' mortgages from banks and other institutions, possibly resulting in the largest bailout in history.

AMPUTATE!

AMPUTATE!

Who Are The Villains?

Bloomberg's Michael Lewis asks and attempts to answer the big question...

Who inside Wall Street dreamed up the first subprime-mortgage- backed mezzanine CDO and allowed BBB credit to be laundered through the credit-rating companies and come out the other end as AAA? Who inside the credit-rating companies made the decision to rubber stamp the paper? Who inside Lehman Brothers -- and at all the other Wall Street firms -- fought to get into the business over the objections of saner traders?

Batting Third...

Money Markets?

Oy.

Meanwhile, Morgan Stanley continues to attempt to save its own ass by negotiating toward a deal with China Investment Corp in preference to being absorbed by Wachovia.

As our Federal government starts owning large investment corporations and thusly making Karl Marx giggle in his grave, its seems only fitting that one of our two remaining large investment banks is dealing with a company that was just infused with $200 billion in cash by the Chinese government last year.

BushCo. Communism We Can Believe In.

Oy.

Meanwhile, Morgan Stanley continues to attempt to save its own ass by negotiating toward a deal with China Investment Corp in preference to being absorbed by Wachovia.

As our Federal government starts owning large investment corporations and thusly making Karl Marx giggle in his grave, its seems only fitting that one of our two remaining large investment banks is dealing with a company that was just infused with $200 billion in cash by the Chinese government last year.

BushCo. Communism We Can Believe In.

Background

I point fingers at Phil Gramm now and then when discussing the current bank implosion, and this is probably a good time to explain why. Gramm was the lead author of the Gramm-Leach-Bliley Act of 1999 (signed by Clinton) that repealed the Glass-Steagall Act of 1933.

Glass-Steagall was enacted during the Depression and specifically prohibited commercial banks from investment banking and brokerage collaboration. It basically protected regular bank depositors from the heightened risks involved with commercial banks investing depositor funds in collateralized loans and taking on unwise high risk-high reward ventures at the expense of regular depositors. It established the concept of bank deposit insurance (the FDIC), regulated the ability of large banks to compete against one another through financial services (a main reason it was repealed), and basically provided a firewall between deposits and securities so that faulty and irresponsible underwriting (giving loans, insurance, and securities to unqualified and high risk borrowers) would not affect the core of depositor banking in times of crisis.

Backers of the Gramm bill (with a big push from Fed chairman Alan Greenspan) saw the GSA as a chokehold on the banking industry - banks were forced to create entirely separate companies with an entirely separate capital base in order to function in the investment field, and pretty much banned bankers from the underwriting game.

One of the vehicles used to get around the GSA was the Savings and Loan Association, or Mutual Savings Bank, which had an entirely different set of rules. S&Ls were granted the authority to allow consumer and commercial loans, NOW accounts, and issue credit cards in 1980, and in a microcosm of what's happening right now, a slowdown in the real estate market essentially buried the unregulated S&L industry by 1990. The industry was rife with corruption, highlighted by the Lincoln S&L investigation involving five US Senators, including Charles Keating and John McCain.

Repealing the GSA opened the business opportunities for banks and allowed them to get into home and auto loans, global investments, and to take gains from one sector and invest them into others. The result of that deregulation was monolithic banking institutions with massive amounts of debt tied into credit and the booming real estate industry, with interest from those massive mortgage gains tied to auto loans, insurance, and foreign investments in the name of bigger profits.

And then the real estate boom went away. Those mortgages - some issued at subprime rates, some not, became assets valued below the loans attached to them. The money coming in against the mortgage values turned upside down, there was no liquid capital to cover the debts that those properties were collateralized against, industries like airlines found that their credit providers were asking for more up-front liquidity to cover transactions because of lack of funds elsewhere, people who couldn't manage to pay the mortgage they never should have had in the first place now found themselves unable to make the car payment or the credit card payment, and all those conduits of incoming liquidity to the conglomerate banking institutions basically dried up.

The Federal Reserve Bank, operating under the notion that a large corporation is sacred, has been throwing hundreds of billions of dollars in inflated cash at these failures hoping to stop the house of cards from falling, in turn devaluing the worthless stock its trying to save, creating corporate debt from taxpayer money that may never be repaid, and basically allowing proven irresponsible failures to go back to the table and lose more of my and your money.

GSA was repealed for a reason, but it also -existed- for a reason. We've now seen that the big bankers will play the game as dirty and as irresponsibly as we let them, with no regard for their investors, their country, or their duty. Perhaps the best strategy from here on out should be to kick them out of the game altogether.

.

Glass-Steagall was enacted during the Depression and specifically prohibited commercial banks from investment banking and brokerage collaboration. It basically protected regular bank depositors from the heightened risks involved with commercial banks investing depositor funds in collateralized loans and taking on unwise high risk-high reward ventures at the expense of regular depositors. It established the concept of bank deposit insurance (the FDIC), regulated the ability of large banks to compete against one another through financial services (a main reason it was repealed), and basically provided a firewall between deposits and securities so that faulty and irresponsible underwriting (giving loans, insurance, and securities to unqualified and high risk borrowers) would not affect the core of depositor banking in times of crisis.

Backers of the Gramm bill (with a big push from Fed chairman Alan Greenspan) saw the GSA as a chokehold on the banking industry - banks were forced to create entirely separate companies with an entirely separate capital base in order to function in the investment field, and pretty much banned bankers from the underwriting game.

One of the vehicles used to get around the GSA was the Savings and Loan Association, or Mutual Savings Bank, which had an entirely different set of rules. S&Ls were granted the authority to allow consumer and commercial loans, NOW accounts, and issue credit cards in 1980, and in a microcosm of what's happening right now, a slowdown in the real estate market essentially buried the unregulated S&L industry by 1990. The industry was rife with corruption, highlighted by the Lincoln S&L investigation involving five US Senators, including Charles Keating and John McCain.

Repealing the GSA opened the business opportunities for banks and allowed them to get into home and auto loans, global investments, and to take gains from one sector and invest them into others. The result of that deregulation was monolithic banking institutions with massive amounts of debt tied into credit and the booming real estate industry, with interest from those massive mortgage gains tied to auto loans, insurance, and foreign investments in the name of bigger profits.

And then the real estate boom went away. Those mortgages - some issued at subprime rates, some not, became assets valued below the loans attached to them. The money coming in against the mortgage values turned upside down, there was no liquid capital to cover the debts that those properties were collateralized against, industries like airlines found that their credit providers were asking for more up-front liquidity to cover transactions because of lack of funds elsewhere, people who couldn't manage to pay the mortgage they never should have had in the first place now found themselves unable to make the car payment or the credit card payment, and all those conduits of incoming liquidity to the conglomerate banking institutions basically dried up.

The Federal Reserve Bank, operating under the notion that a large corporation is sacred, has been throwing hundreds of billions of dollars in inflated cash at these failures hoping to stop the house of cards from falling, in turn devaluing the worthless stock its trying to save, creating corporate debt from taxpayer money that may never be repaid, and basically allowing proven irresponsible failures to go back to the table and lose more of my and your money.

GSA was repealed for a reason, but it also -existed- for a reason. We've now seen that the big bankers will play the game as dirty and as irresponsibly as we let them, with no regard for their investors, their country, or their duty. Perhaps the best strategy from here on out should be to kick them out of the game altogether.

.

Let It Burn: A Nutshell

Tony Wikrent spells out how the Wall Street game saps the true economy.. go read the whole thing with graphs and charts and details and stuff..

At the cost of your future, the U.S. financial system is being saved. For a half century, the United States has been unable to find a hundred billion or so a year to fund general healthcare, but now that financial powerhouses like Bear Stearns, Freddie Mac, Fannie Mae, and AIG are crumbling, the U.S. Treasury can magically procure trillions of dollars in promises without so much as a nit of resistance in either chamber of the U.S. Congress.

Your future earnings have now been committed to saving the asses of the millionaire and billionaires who postured as geniuses as they managed and oversaw the financial follies of the past 28 years. The future potential of your country – and the future potential of your children and grandchildren, is being wasted, now, to save a financial system that subtracts real value from the economy; a financial system that enriches the few by impoverishing the many.

...

Empire building and increased managerial compensation are often a primary motive behind bank mergers. Forbes reported last week that the five principals of Goldman Sachs were paid over $300 million. This is really what the game has been about for the past thirty years.

Once we have eliminated the big Wall Street institutions that have been essentially looting the economy, and redirected the financial system back to providing capital for capitalism, we need to ensure that speculation does not again become a problem. The best and easiest thing to do is simply to tax speculation.

...

After being the most profitable business on Wall Street, generating more than $65 billion in pretax profits for the four largest U.S. securities firms between 2002 and 2006, trading has become a black hole. It still accounts for about half of the revenue at the Wall Street firms. Yet Lehman Chief Executive Officer Richard Fuld and Merrill CEO John Thain have been unable to convince shareholders to attach a value to the businesses.

So what if we as a society now prohibit the masters of the universe from trading? It seems we would actually be doing them a favor. But let’s do ourselves a favor, and just shut down the whole damn casino.

...

As of this past Monday morning, only two independent investment banks are left standing: Morgan Stanley and Goldman Sachs. Is there any doubt that either of these companies is indeed now “too big to fail”? And what about Bank of America, which swallowed Merrill Lynch? If these companies are “too big to fail” why should we as a society wait to see if we will have to bail them out in case of their failing? They should be immediately broken up ... The entire idea of national banking companies should be abandoned as a badly failed experiment. What about having to compete in the global marketplace? Let’s face facts: ever since U.S. banks have been deregulated to be better able to compete in the global marketplace, they’ve had their asses handed to them over and over again. Let’s just accept that deregulation is a failed experiment, and accept the fact that a strictly regulated domestic banking system, geared only to domestic needs, is actually the strongest and safest.

In fact, when you look at what our country’s needs are, you see just how spectacular a failure the whole conservative experiment in deregulation and “free markets” has been. We need to move off of a dependence on fossil fuels. How much progress has been made toward that goal in the past 28 years? Practically none. We have not even been able to maintain our existing infrastructure adequately, let alone build new infrastructure to meet national requirements – such as urban mass transit rail systems. Of the 39 largest U.S. urban areas, beginning with Nashville, Tennessee which has a population of over 1.2 million, thirteen have no urban rail transit at all, and another five have less than 20 kilometers of rail line. Houston, Texas, now the sixth largest U.S. metropolis, with an urban population of 4.2 million, has a laughable twelve kilometer “system” served by sixteen stations. If the financial system has been unable to steer investment into this crying need, then let’s just let the damn thing collapse. It’s really of no use to our society.

As Dean Baker concluded:

The basic story is Wall Street has our money. There will be innocent victims in the battle to rein in Wall Street: the administrative assistants, the custodians, the ordinary workers who will also lose their jobs. This is unavoidable. If we eliminated sweetheart defense contracts with Halliburton and Blackwater, innocent people would also lose their jobs, however few would argue that we should therefore continue to throw taxpayer money in the garbage paying exorbitant fees to these firms.

We have an historic opportunity to correct one of the major distortions to the U.S. economy if we move now. There is no way to reverse the growth in inequality over the last three decades without attacking the elite Wall Street crowd. Those folks who back away from this task simply are not serious about addressing inequality. They have our money. It's that simple.

Wednesday, September 17, 2008

Bob Barr - Its So Crazy It Just.. Might.. Work..?

Bob Barr, slightly loony Republican former Senator - turned - overly loony Libertarian Presidential candidate, has filed suit to get both McCain and Obama booted from the November ballot in the state of Texas, claiming that both candidates missed the August 26th filing deadline because neither candidate had been officially nominated by his respective party.

Fascinating, Captain..

Texas law requires that written certification of the party’s nominees be delivered before 5 p.m. of the 70th day before Election Day. This year, the deadline fell on Aug. 26.

Barr’s campaign contends that because neither candidate had been nominated by the official filing deadline, it was impossible for them to file under Texas law.

...

Barr, a former Republican congressman from Georgia, is expected to press his case Thursday at the Texas Supreme Court. It is the campaign’s first legal action accusing the major-party candidates of not qualifying to run in a state. The campaign is not planning to file lawsuits in other states, a Barr spokesman said.

Neither Obama nor McCain’s campaign would comment on the suit, but the office of Texas Secretary of State Esperanza “Hope” Andrade said it certified the Nov. 4 general election ballot on Sept. 3.

...

“The facts of the case are not in dispute,” Barr campaign manager Russell Verney said. “Republicans and Democrats missed the deadline, but were still allowed on the ballot.

“Third parties are not allowed on the ballot for missing deadlines, as was the case for our campaign in West Virginia, yet the Texas secretary of state’s office believes Republicans and Democrats to be above the law.”

Fascinating, Captain..

Not Just Here

Lloyd's TSB in London has agreed to an emergency takeover of Scotland's Halifax Bank for 12 billion pounds $21.8 Billion American), a deal that could eliminate 40,000 jobs, close hundreds of branches, and affect two million shareholders.

In The Hole..

.. Morgan Stanley, one of the two remaining major American investment bankers and a descendant of the original J.P. Morgan company, doesn't seem to be in utterly dire condition yet but is nonetheless seeking a savior, namely in Wachovia.

The Bush administration has trumpeted for 8 years that carrying massive debt is not a negative factor in the modern economy. They speak of the nation's federal finances when they say this.

The MBA president would like us to think that a $9.7 trillion 'general fund' debt isn't a big deal.

These major investment institutions are dying because they are unable to answer actual and potential margin calls because their liquidity is depleted by bad mortgage lending (and the subsequent collateral investment of that capital in other vehicles such as insurance and vehicle loans), practices that were illegal before the gradual deregulation of the industry by, among others, John McCain and Phill Gramm.

On the federal level our debts are owed to other countries who will not default because we aren't paying them back. That said, countries like China that hold our IOUs pretty much dictate the terms of how that money gets repaid, and Bush/McCain sees no need or interest in leveling the ledger anytime soon.

I think we're starting to see where that mentality gets us.

The Bush administration has trumpeted for 8 years that carrying massive debt is not a negative factor in the modern economy. They speak of the nation's federal finances when they say this.

The MBA president would like us to think that a $9.7 trillion 'general fund' debt isn't a big deal.

These major investment institutions are dying because they are unable to answer actual and potential margin calls because their liquidity is depleted by bad mortgage lending (and the subsequent collateral investment of that capital in other vehicles such as insurance and vehicle loans), practices that were illegal before the gradual deregulation of the industry by, among others, John McCain and Phill Gramm.

On the federal level our debts are owed to other countries who will not default because we aren't paying them back. That said, countries like China that hold our IOUs pretty much dictate the terms of how that money gets repaid, and Bush/McCain sees no need or interest in leveling the ledger anytime soon.

I think we're starting to see where that mentality gets us.

Lest We Forget

McCain must feel like old times now that the Keating Five-era deregulation party he helped start in the 80s has reached high tide again.

Its a fair assumption that John McCain will have no interest in trying to restore rules and order to the investment industry, regardless of how far under the barrel it sinks.

Its a fair assumption that John McCain will have no interest in trying to restore rules and order to the investment industry, regardless of how far under the barrel it sinks.

On Deck...

Atrios predicts that WaMu could quietly join the list of Friday Afternoon Bank Failures this week, followed by the bigger problem: the FDIC will fall below minimum congressional target levels and will likely require a bailout itself.

Meanwhile, Sean-Paul Kelley redirects this question: "We can nationalize the nation's largest insurer but not have national healthcare?

Good grief indeed. Let 'em burn.

Meanwhile, Sean-Paul Kelley redirects this question: "We can nationalize the nation's largest insurer but not have national healthcare?

Good grief indeed. Let 'em burn.

Ike: The Eye Of The Truth

We the distanced public are in that deceptive calm time after a disaster, where information is scarce, media priorities are elsewhere, and no power and no access means very little news. That said, rumors and eyewitness accounts are starting to surface from the West Galveston and Bolivar Peninsula areas in Texas of catostrophic damage and 'up to 1500 floating corpses' and the FAA has had created a no-fly zone over the area. Not good.

Virgotex and First Draft are on it. The Houston Chronicle has the official line. Pass it on.

Virgotex and First Draft are on it. The Houston Chronicle has the official line. Pass it on.

Where The Hell Are They Getting This Money?

We can't repair a school or a bridge in this country, but AIG gets a last-second $85 Billion Federal buyout despite not really being a bank.

On deck? Probably WaMu. Then what? Does GMAC count? Wonder if GM could pull off that technicality - Chrysler needed congressional approval to get bailed out in the 80s..

Free money! Just fuck up enough to grab some.

On deck? Probably WaMu. Then what? Does GMAC count? Wonder if GM could pull off that technicality - Chrysler needed congressional approval to get bailed out in the 80s..

Free money! Just fuck up enough to grab some.

Tuesday, September 16, 2008

... and while we're at it..

...Eric Boehlert at Media Matters digs into the media's irrational willingness to tee up McCain talking points without challenging their merit over and over again, to the point of professional embarrassment.

Does it matter? Not really. The McCain camp is obviously pressing on with the notion that as long as the lies are published and broadcast as truth, no one ever reads the corrections. A lie distributed is a fact.

Does it matter? Not really. The McCain camp is obviously pressing on with the notion that as long as the lies are published and broadcast as truth, no one ever reads the corrections. A lie distributed is a fact.

All Is Well.. All Is Well... SURPRISE !!

The Columbia Journalism Review sums up the media's overall negligence by not bringing the looming economic trainwreck to the frontpages before Monday's freefall.

[The public] might have known, sure, about Lehman’s woes. And they may have received snippets of information about Merrill and AIG and the rest that, taken together, could have foreshadowed a bit of today’s Big Bang. They knew, generally, that the economy’s a mess right now—and that Wall Street’s follies are partially to blame.

But that today would be Black Monday? That those discrete “warning signs,” such as they were, would suddenly merge and morph into a “full-blown crisis”? Not so much.

And that, I’d argue, is in part the fault of the press. And, specifically, it’s the fault of the atomized structuring of financial reporting, which keeps Wall Street insiders excessively informed about the market’s most minor whims … and outsiders (read: everyone else) essentially uninformed until, as today, catastrophe befalls the market. In which case, the outsiders are suddenly and unceremoniously brought into the circle of information with doomsday-esque headlines like “FINANCIAL CRISIS” (NYT) and “Markets Tumble…” (AP) and “Market Plunges…” (LA Times) and “BLACK MONDAY: World Stocks Sink” (Huffington Post) and the like on the front pages of the news outlets of record.

Compare the WSJ’s and the FT’s and Bloomberg’s and the business pages’ treatment of the current crisis, in the days and weeks leading up to it, to the straight news pages of The New York Times and The Washington Post and the like. Rather than focus, in those days and weeks, on the incidents that led to today’s plunge, general-interest news outlets focused fairly myopically on … the presidential campaign. And, within that, Sarah Palin (“qualifications to be Vice President of,” “governorship of,” “family of,” “fashion sense of,” “recreational habits of,” “porcine allusions to,” etc.). Indeed, in the coverage of the presidential campaign, Palin and Palin-Related Minutiae comprised a whopping 60 percent of last week’s campaign coverage, according to the Project for Excellence in Journalism.

The financial crisis, either current or looming? Didn’t even make the cut.

That crisis is very tangibly a campaign issue; but it was virtually ignored as such in general-interest reportage, and got very little coverage outside of the business-press niche. Which led, last week, to a populace of news consumers aware that Todd Palin is a champion snowboarder and that his seventeen-year-old daughter will marry the father of her unborn baby…but not that the national credit crisis would, this weekend, be reaching (what we can only hope is) its nadir.

Monday, September 15, 2008

Holy Fucking Stupid Batman!

The Fed has decided to allow civilian banks to throw depositor money at their investment problems..

That's right. Your savings account is now all-in on red. Yay.

That's right. Your savings account is now all-in on red. Yay.

The Bush Flameout

Posted about 10 days ago - RollingStone.com has a 16-page chronology of Bush's approval-rating freefall, noting the highs and lows of "the longest sustained period of public disapproval" in the history of the American presidency.. the whole list is numbing but worthwhile to read through, but here's a Cliff's Notes version:

and I'll add one:

August 6, 2001

Presidential Daily Brief: "Bin Laden Determined to Strike in U.S."

Approval Rating: 57%

September 11, 2001

"The Pet Goat"

86% (Sept 14-15)

September 10, 2002

Cheney: "There is no doubt that Saddam Hussein now has weapons of mass destruction."

70%

February 5, 2003

Colin Powell bullshits U.N.

61%

May 1, 2003

"Mission Accomplished"

69%

July 2, 2003

Bush to insurgents: "Bring 'em on!"

62%

December 21, 2003

Saddam captured

60%

April 28, 2004

First photos of Abu Ghraib surface.

49% (May 2-4)

November 2, 2004

Bush re-elected

53%

August 29, 2005

Katrina hits; Bush flies to Phoenix for John McCain's birthday.

46%

December 2005

U.S. deaths in Iraq reach 2,000.

43%

March 29, 2006

Republican lobbyist Jack Abramoff convicted.

37%

November 6-7, 2006

Democrats regain control of House and Senate.

Rumsfeld resigns

33%

December 2006

U.S. deaths in Iraq reach 3,000.

37%

June 11, 2007

Sen. Larry Craig arrested

29%

August 13, 2007

Karl Rove resigns.

33%

February 28, 2008

Bush: "Wait, what did you just say? You're predicting $4 a gallon gasoline? That's interesting. I hadn't heard that."

32%

March 2008

U.S. deaths in Iraq reach 4,000.

28%

August 2008

Bush White House projects it will leave America with a record defict of $482 billion.

29%

and I'll add one:

September 15, 2008

Lehman Brothers declares chapter 11 bankruptcy with $613 billion in listed debt, days after public investors Bear Stearns, Fannie May, and Freddie Mac received federal bailouts, Merrill Lynch was bailed out by Bank of America for roughly $50 billion, and the Dow lost 500 points and 4% of its worth.

29% (USA Today/Gallup)

RIP Richard Wright

He was 65.

People have asked me at various times in my life who my particular influences are as a musician, and I've always had trouble with that. I grew up on radio - I wasn't a buyer of albums and CDs as a kid, and because of that I never really knew the names of the players I grew to love and respect when I was younger. The internet has allowed me to go back and really get to know all the artists I liked somewhat anonymously through the years.

That Guy From Pink Floyd was always one of my favorite keyboard players. He was equally adept at analog synth mind theater stuff as the core piano-organ stuff that was his foundation, but between the remarkable backgrounds underneath Dark Side Of The Moon and the amazing introductory Shine overture on Wish You Were Here and beyond, Richard always had something to say inside an arrangement.

I'm not a big Floyd fan, but Wright's work always impressed me with its taste and simplicity. I learned a lot from listening to his work.

Thursday, September 11, 2008

... on the other hand ...

... I'd like to thank John McCain for exposing us to one of the greatest internal dangers our country has ever faced - possibly worse than McCarthy, possibly worse than W, possibly worse that Nixon - long before she put in the time and experience to manufacture a facade of moderate credibility and develop a skillset and network of like-minded nutcases like John McCain has.

Thanks, big guy.

Thanks, big guy.

A Clear And Present Danger

I'm starting to reluctantly agree with Josh Marshall: four more years of Bush might actually be preferable to a term of Gramps and Wacko.

Holy hell.

Holy hell.

Deep Thought - Like Substance

So.. if Hurricane Ike gets all Blow'd Up on greater metropolitan Houston, will W then try to invade Ike because it tried to kill his dad?

Seriously, irony and sadness aside for a second, would W react to a possible Houston catastrophe with all the Presidentin' and vitriol that he should have for That Other Sinful Dark Person Place That Doesn't Matter So Much?

I bet Houston would be treated like the sick child - "anything and everything for my baby". New Orleans was treated like the sick hamster - "wow, that bill is steep. Never mind."

(how trendy is this whole 'deep thought' thing anyway?)

Seriously, irony and sadness aside for a second, would W react to a possible Houston catastrophe with all the Presidentin' and vitriol that he should have for That Other Sinful Dark Person Place That Doesn't Matter So Much?

I bet Houston would be treated like the sick child - "anything and everything for my baby". New Orleans was treated like the sick hamster - "wow, that bill is steep. Never mind."

(how trendy is this whole 'deep thought' thing anyway?)

"Shame On You, You Manipulative Hypocrites!..."

Watch all of this: new American citizen Craig Ferguson knows us better than we do..

"If You Don't Vote, You're A Moron.."

...

"Do Me The Honor Of Being Fellow Americans.."

"If You Don't Vote, You're A Moron.."

...

"Do Me The Honor Of Being Fellow Americans.."

Wednesday, September 03, 2008

Tuesday, September 02, 2008

From Russia With Love - The Medvadev Doctrine

Russian President Dmitry Medvadev has laid out Russia's assertions on how they plan to handle and be handled by the west. Worth a read.

Actual Journamalism

Kudos to CNN's Campbell Brown for actually asking a solid question and sticking to the guy when he tries to escape it. Didn't know that was still possible.

(TPM)

(TPM)

Just Give Me The Damn Nameplate

I've said many times, in this space and others, that the fundamental problem with the standing republican ideology is that one cannot effectively govern when one does not actually believe in government in the first place.

So, almost needless to say, I very much agree with the Left Blogosphere's take this morning that John McCain really isn't interested in actually running things.

He's campaigned with an attitude of 'for chrissakes just make me President already - I was a POW!' for years, and his sense of entitlement is leaking into everything now. He wants the job, he just doesn't want to -do- the job once he gets it.

I don't think we really need to go through that again.

So, almost needless to say, I very much agree with the Left Blogosphere's take this morning that John McCain really isn't interested in actually running things.

He's campaigned with an attitude of 'for chrissakes just make me President already - I was a POW!' for years, and his sense of entitlement is leaking into everything now. He wants the job, he just doesn't want to -do- the job once he gets it.

I don't think we really need to go through that again.

All You Really Need To Know

John McCain has hired Tucker Eskew, the very guy Bush hired to smear McCain during their 2000 campaign battle in South Carolina, as a consultant to help prepare running mate Sarah Palin for speech and debate season.

He was against it before he was for it.

He was against it before he was for it.

Monday, September 01, 2008

Talking Point

We're almost through an eight year administration where just about every appointee or nominee ended up in some sort of scandal. McCain has made one choice as to who will lead in his administration, and she's already at a scandal-per-day pace in less than a week. Why would anyone think McCain has any idea how to do the job of selecting people to help him run the nation?

The President is elected not to rule, but to hire the people who make government happen. John McCain has demonstrated that he has no concept of how to do this job.

The President is elected not to rule, but to hire the people who make government happen. John McCain has demonstrated that he has no concept of how to do this job.

Subscribe to:

Posts (Atom)