Wednesday, December 17, 2008

Four Thousand People Died...

...because they 'had to die'...

Sunday, December 07, 2008

Sunday, November 30, 2008

Deep Thought

Would anyone be okay if India specifically declared war on Pakistan based on these terrorist attacks based on our precedent?

Bonus: would anyone be okay if, in holding with our precedent, India decided to skip Pakistan altogether and invade Nepal or Bagladesh for the hell of it?

Bonus: would anyone be okay if, in holding with our precedent, India decided to skip Pakistan altogether and invade Nepal or Bagladesh for the hell of it?

Thursday, November 20, 2008

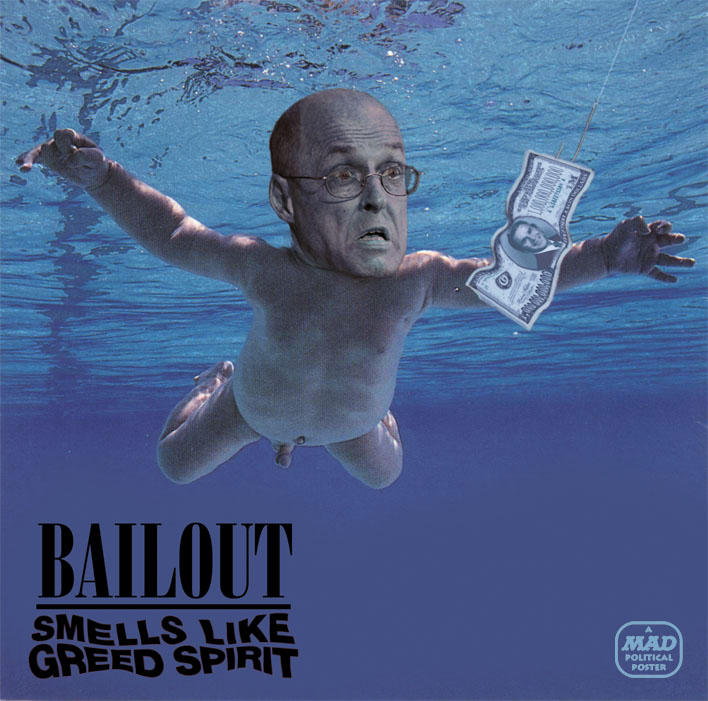

Next..

.. Citigroup, the monolith that pretty much brought forth the repeal of Glass-Steagall in the first place, appears to be next in like for the can..

Wednesday, November 19, 2008

"Let The Record Show, No Hands Went Up.."

The big three automakers testified before congress today begging for bailout money and got bitchslapped for flying their private jets to Washington..

Peter Schiff Was Right

.. and Arthur Laffer, like most very serious people, was really, really wrong..

This is from two years ago..

(h/t Eldridge)

This is from two years ago..

(h/t Eldridge)

Deep Thought

We'd be better off had Ned Lamont won the general election and not just the primary.

Don't Drive Angry

Nate at 538 gets John Ziegler on the line, and hilarity ensues..

I agree with one of the commenters, in that I think Nate actually should have been better versed on the poll contents. But the main points were made, and Ziegler totally went nutcase douchebag on him. Nice work!

I agree with one of the commenters, in that I think Nate actually should have been better versed on the poll contents. But the main points were made, and Ziegler totally went nutcase douchebag on him. Nice work!

Tuesday, November 18, 2008

Sayonara, Jackass

Mark Begich's lead over Ted Stevens has passed the recount threshold, AP calls the race.

Thursday, November 06, 2008

I Got Your Riot Right Here II

Seattle, from The Stranger

Yes, its the horrid dancemix version. Still, dancing in the streets. Mr. Obama tore down this wall.

Wednesday, November 05, 2008

Quote O' The Day

I confess a certain impatience, on this poignant day, with all the earnest talk about how America achieved something remarkable yesterday by electing our first African-American president, as if the choice has been about race all along. I do not mean to diminish an historic first, like electing a Catholic in 1960; I, too, choked-up when John Lewis spoke. But relief today is not about Americans choosing an obviously black man over a white man, which proves we can come to terms with our past. It is about our choosing an obviously brilliant, reciprocal man over a thick, cynical one--a man who articulates a coherent vision of global commonwealth over someone advancing vague, military patriotism--which proves we can come to terms with our future.

-- Bernard Avishai at TPM

Tuesday, November 04, 2008

Free At Last

I got the girls down for bed tonight (part one of three), came downstairs, watched the end of the 9News update on evil Musgrave losing and 'Boulder Liberal' Udall winning, and then they cut back to NBC national with a graphic "Senator Barack Obama Elected 44th President Of The United States"...

I sat there for a second, and the first thought that came into my head was my grandmothers living room, where she has the Martin Luther King memorial plate that every african american over the age of 60 has somewhere.

And I totally lost it. A perfectly thorough five minute cry.

Then, of course, I had to go upstairs again. But I just got completely overwhelmed by it, the eight years lifted, the struggles of my family and everyone who ever got called a name for looking like me, it all fell off, if only for a minute.

I don't know how well he'll do - the task is epic and virtually insurmountable. But I remember four years ago yesterday, November 3rd, 2004, I woke up the morning after Bush's inconceivable reelection, knowing that my second child would come into the world later that day.

I'm hoping her world just got a little better.

I sat there for a second, and the first thought that came into my head was my grandmothers living room, where she has the Martin Luther King memorial plate that every african american over the age of 60 has somewhere.

And I totally lost it. A perfectly thorough five minute cry.

Then, of course, I had to go upstairs again. But I just got completely overwhelmed by it, the eight years lifted, the struggles of my family and everyone who ever got called a name for looking like me, it all fell off, if only for a minute.

I don't know how well he'll do - the task is epic and virtually insurmountable. But I remember four years ago yesterday, November 3rd, 2004, I woke up the morning after Bush's inconceivable reelection, knowing that my second child would come into the world later that day.

I'm hoping her world just got a little better.

Monday, November 03, 2008

A Smidge Of Justice

Georgia, which is now very much in play, may swing to Obama because Republicans delberately and systemically shorted the number of voting machines in many precincts, but Dem voters and volunteers have been willing to stand in the early voting lines while Republican volunteers and voters haven't.

Sunday, November 02, 2008

Dem Sox

I remember October 27th, 2004. The Red Sox, with 86 years of downright eerie failure behind them, were one out away from winning the World Series. This was a week after being one out away from losing the ALCS to the Yankees. As a peripheral Red Sox follower since I was a kid, I was amazed to be sitting there watching the game with one out to go in game four thinking 'don't get excited'..

They'd been so destined for ultimate failure for so long, by whatever power bestows that kind of thing, that I couldn't even stand up. Couldn't smile. Couldn't move, couldn't begin to accept it until Doug Mientkiewicz caught the last ball and went nuts.

If you're someone who has watched the Republicans run us aground and demean and degrade those who disagreed with them over the last eight years, then you know this feeling well. Tuesday can't come fast enough.

It needs to be over. I'm petrified. All signs are positive, but so what. Bucky FUCKING Dent, Aaron Boone, Al Gore, it's all the same.

Wake me up Wednesday.

They'd been so destined for ultimate failure for so long, by whatever power bestows that kind of thing, that I couldn't even stand up. Couldn't smile. Couldn't move, couldn't begin to accept it until Doug Mientkiewicz caught the last ball and went nuts.

If you're someone who has watched the Republicans run us aground and demean and degrade those who disagreed with them over the last eight years, then you know this feeling well. Tuesday can't come fast enough.

It needs to be over. I'm petrified. All signs are positive, but so what. Bucky FUCKING Dent, Aaron Boone, Al Gore, it's all the same.

Wake me up Wednesday.

Friday, October 31, 2008

The Storyteller Rests

Not just his own story, but everyone's. Go read some Studs Terkel this weekend.

Thursday, October 30, 2008

Quote O' The Day

I hope that in January, after Mount Rushmore has been re-carved with the faces of Malcolm X, Muhammad Ali, Jeremiah Wright, and Aretha Franklin; after "Fuck tha Police" becomes the new national anthem; after all cigarettes are outlawed except for Kools and Newports; after we've all been forced to become Commie Muslim atheists; after President Obama hands the nuclear launch codes to al-Qaeda; after abortions are not only fully funded but mandatory; after Rastus Odinga Odinga becomes Secretary of State; and after we've all been interned in Learn How To Hate Whitey camps--after all of that, I hope that Caliph Obama Marx X institutes some serious statistical re- education programs, so we won't ever have to deal with this kind of stupid again.

I would have said that we'd have Huey Newton, Nat Turner, and Stokely Carmichael on our money, but of course we won't need any money in our coming Worker's Paradise, now will we, Comrade?

-- Jude, on a roll..

Wednesday, October 29, 2008

Random Thought

A lot of people will watch this world series game tonight not because its a unique completion to a suspended game, but because it promises to likely be over well before midnight eastern..

Tuesday, October 28, 2008

Quote O' The Day

"The problem with the economy is that it is no longer economy-sized.."

-- John Stewart

Monday, October 27, 2008

One Small Problem

No one told the banks they couldn't just hold onto the bailout money..

Our Liberal Media

...at work.

I only wish Biden had been able to sneak a "Jane, you ignorant slut!" into it somewhere..

I only wish Biden had been able to sneak a "Jane, you ignorant slut!" into it somewhere..

Sunday, October 26, 2008

It Has To Be Good News For McCain.. Somehow..

Anchorage Daily News endorses Obama..

Alaska's founders were optimistic people, but even the most farsighted might have been stretched to imagine this scenario. No matter the outcome in November, this election will mark a signal moment in the history of the 49th state. Many Alaskans are proud to see their governor, and their state, so prominent on the national stage.

Gov. Palin's nomination clearly alters the landscape for Alaskans as we survey this race for the presidency -- but it does not overwhelm all other judgment. The election, after all is said and done, is not about Sarah Palin, and our sober view is that her running mate, Sen. John McCain, is the wrong choice for president at this critical time for our nation.

Sen. Barack Obama, the Democratic nominee, brings far more promise to the office. In a time of grave economic crisis, he displays thoughtful analysis, enlists wise counsel and operates with a cool, steady hand. The same cannot be said of Sen. McCain.

Andy! Opie! Fonzie! Time For Dinner!

About halfway through I realized they should be endorsing the Wig Party*...

* sorry

* sorry

Friday, October 24, 2008

The Dumb, It Burns (Part 4 billion)

Josh is all over this, but it seems to me like this could be the last nail in the McCain campaign coffin if it gets reported correctly.

And staging a black man - on - white woman attack is bad enough as it is.

And staging a black man - on - white woman attack is bad enough as it is.

Tuesday, October 21, 2008

Monday, October 20, 2008

Quote O' The Day

It's quite a blow for McCain on each point. But the most galling must be what Powell said about his judgment, his steadiness in moment's of crisis. Powell and McCain are both in their early 70s. Obama is a quarter century younger. And in so many words Powell said that compared to Obama, McCain simply lacks the seasoning, the maturity to be president.

-- Josh

Saturday, October 18, 2008

Airport Insecurity

Awesome. Frightening.

During one secondary inspection, at O’Hare International Airport in Chicago, I was wearing under my shirt a spectacular, only-in-America device called a “Beerbelly,” a neoprene sling that holds a polyurethane bladder and drinking tube. The Beerbelly, designed originally to sneak alcohol—up to 80 ounces—into football games, can quite obviously be used to sneak up to 80 ounces of liquid through airport security. (The company that manufactures the Beerbelly also makes something called a “Winerack,” a bra that holds up to 25 ounces of booze and is recommended, according to the company’s Web site, for PTA meetings.) My Beerbelly, which fit comfortably over my beer belly, contained two cans’ worth of Bud Light at the time of the inspection. It went undetected. The eight-ounce bottle of water in my carry-on bag, however, was seized by the federal government.

...

As we stood at an airport Starbucks, Schneier spread before me a batch of fabricated boarding passes for Northwest Airlines flight 1714, scheduled to depart at 2:20 p.m. and arrive at Reagan National at 5:47 p.m. He had taken the liberty of upgrading us to first class, and had even granted me “Platinum/Elite Plus” status, which was gracious of him.

...

To slip through the only check against the no-fly list, the terrorist uses a stolen credit card to buy a ticket under a fake name. “Then you print a fake boarding pass with your real name on it and go to the airport. You give your real ID, and the fake boarding pass with your real name on it, to security. They’re checking the documents against each other. They’re not checking your name against the no-fly list—that was done on the airline’s computers. Once you’re through security, you rip up the fake boarding pass, and use the real boarding pass that has the name from the stolen credit card. Then you board the plane, because they’re not checking your name against your ID at boarding.”

What if you don’t know how to steal a credit card?

“Then you’re a stupid terrorist and the government will catch you,” he said.

What if you don’t know how to download a PDF of an actual boarding pass and alter it on a home computer?

“Then you’re a stupid terrorist and the government will catch you.”

Rantage

Why do the cycle-trons keep subjecting us to piles of so-called undecided voters? Why do they matter? Unless you're 18 and newly unoblivious or someone who just became a citizen, what kind of idiot do you have to be to be undecided at this point?

Know any football fans that don't have a favorite team? See, exactly. There's always one and that particular one has no capacity for rational thought and needs rides places and owes you money. Fuck him.

Same dumbass, different magnitude.

Know any football fans that don't have a favorite team? See, exactly. There's always one and that particular one has no capacity for rational thought and needs rides places and owes you money. Fuck him.

Same dumbass, different magnitude.

Thursday, October 16, 2008

Beer Me!

WaPo's Dana Milbank takes us on a tour of the official on-site debate beer tent...

Wednesday, October 15, 2008

Good News For McCain, Of Course..

Markets plummet - another 7% off the top..

Halfrican*

The NYT digs into people (specifically Alabamans) who seem to be against Obama because he's racially 'other' and, ya know, that ain't right..

* (a term created by me good friend Archie back in the day to describe me.. I still use it because its accurate and funny..)

* (a term created by me good friend Archie back in the day to describe me.. I still use it because its accurate and funny..)

Tuesday, October 14, 2008

"I'm Hot Enough That I Know I Have Your Attention For At Least 30 Seconds.."

See more Hayden Panettiere videos at Funny or Die

Is Our Children Learning?

No idea if this is real, but the 2.2 GPA, 841 SAT score, and 39th percentile vocabulary certainly sound presidential to me..

Link to full size..

Link to full size..

Astounding

Boston.com has a series of mostly aerial photos collected from the 13 days of hurricane Ike..

.. truly, sadly, amazing.

(h/t T-Love)

.. truly, sadly, amazing.

(h/t T-Love)

Monday, October 13, 2008

Anomaly Of Sorts

Atrios points out that Obama's favorability ratings are polling higher than his actual voter support ratings.

I wonder if that's "I favor him but I vote Republican"; "I like him but I don't know if he will be a good president"; or "I favor him but there's no way in hell I'm voting for a [racial and/or religious adjective] man.."

I wonder if that's "I favor him but I vote Republican"; "I like him but I don't know if he will be a good president"; or "I favor him but there's no way in hell I'm voting for a [racial and/or religious adjective] man.."

Leadership: They Haz It

Europe has united behind British Prime Minister Gordon Brown's actions* to head off major bank failures in the global markets.

*[almost said 'plan' instead of 'actions', but they're actually doing stuff unlike whatever the flying fuck Washington is not doing..]

*[almost said 'plan' instead of 'actions', but they're actually doing stuff unlike whatever the flying fuck Washington is not doing..]

Strategery

Nate at fivethirtyeight.com senses a trial-balloon of mainstream wingnut media*-planted strategy coming from the McCain camp as they try to salvage the final four weeks..

* - [if you consider Kristol and Drudge to be 'mainstream media'..]

* - [if you consider Kristol and Drudge to be 'mainstream media'..]

Just Do It

The Brits go right at the problem while Paulson fiddles his way around the jingoistic complexities of "Femafication"..

[and congrats to Paul Krugman for bringing home the hardware..]

[and congrats to Paul Krugman for bringing home the hardware..]

Sunday, October 12, 2008

How About Some Good News

Accidental discovery of 'black silicon' could change the fields of solar power, night vision, and photography forever, 100 to 500 times more light-sensitive than regular silicon and at no additional expense to manufacture..

The Short-Term Problem

Stirling Newberry:

Right now there is a simple problem. There are three market participants in the short term credit market. The Fed, the equities buyers, the banks. These are relatively much, in order, the government's preferred demand target, the demand for money, and the demand for interest. Right now they have radically different ideas of what the prices are. The Fed has interest rates at 1.5%, though this is an emergency cut from the 2% they had before. The equities market thinks that interest should be about .5%. That's why the hot money from the equities market has flooded treasuries, and what the cost of short term money is. The banks think that overnight rates should be somewhere between 3% and 6%.

That's why the credit markets are seizing up, there is no way to get the market to clear if the people who want money see the basic risk premium as low and it is time for a steep yield curve and expansion, the people who are the proxy for controlling demand think it is time for a shallow yield curve and moderation between growth and inflation, and the people charging for money think that the inflation and risk premiums are high. One doesn't need to invoke non-existent "counter-party risk." In fact, the LIBOR curve says the reverse: if it were counterparty risk, then long term libor rates would be much higher. But they aren't. If it is risky to loan today, then why is it less risky to loan for a year? It isn't. Banks aren't lending because rates are not attractive.

So who is right? Well, all of them, and that is the short term problem.

...

The simple spread between the Fed rate, and inflation expectations, alone, would be enough to create a problem. But this problem has created a second problem: namely that banks now must charge for new CDS [Credit Default Swap -ob] rates. The "toxic waste" isn't clogging balance sheets as much as the inability to get default insurance at reasonable rates, is making it unwise to lend, especially in the context of deflationary expectations.

That is, why make a risky loan today, when you can buy the asset itself tomorrow at book value?

This means that what is driving the banks is liquidity preference, but not out of fear of the unknown, but fear of the known.

...

Now if the Congress were an effective body, one that was capable of working on policy, and Ben weren't "Captain Carnage" there are solutions. However, Congress is eager to bribe constituents. It wants to send out more checks to people. Joy. More inflationary idiocy. Not that the executive has garnered a great deal of trust, but this Congress has proven itself to be innumerate, incompetent, and invertebrate.

What then must happen is a combination of fiscal and monetary policy which is designed to prop up those hit with the lack of liquidity and rising risks, and at the same time a club to beat down those risks. Congress, rather than talking about giving people more money to do the wrong things, should be finding ways of dramatically slashing consumption. Not for general austerity's sake - contraction and liquidation are not the point - but to free up resources for the deeper project.

...

Thus, this crisis will not be pretty, but the powers that be have learned nothing from it. Their response will be to overheat the old economy. Drill! Dig! Burn! will be the order of the day. Build coal plants! Drill for Gas! Drill! Drill! Note that they say drill, and not extract. Drilling holes in the ground, by itself, is not a meritorious activity. There needs to be something down there to drill for.

Short term it is time to be buying equities, because there will be a hard bounce when this new and improved ponzi scheme - and now that is where we are, in the land of paper money ponzi schemes, were new people coming into the economy will be paying for people who want to bail out - gets put on line. However, it is no more destined to last than the rally after the Iraq War. A rally that is now fully discounted as having been invested in all the wrong places.

...

But that's their view: fix the paper, and then go back to borrow and squander. Far from critiquing the "failed policies" of Bush, so far, they are promsing merely a repetition of them, run by different people. That may help in the short term, because Bush's ability to execute on even his own plans is feeble. The only thing he's ever been good at is stealing elections, or engaging in a leveraged buy out of them. However, the basic premise, that we can go back to land flipping and burger flipping internally, while making our money by blowing up Baghdad one block at a time, is fundamentally flawed.

This means, absent a sudden and completely unexpected attack of sanity, in a few years, we will be back here, only worse.

The American people have decided to ride this bucket all the way down. There will be a bounce off this ledge, but not one that people should have any faith in, because the leadership, like the public, is in a simplistic mode of demanding that we go back to doing all the wrong things, and solemnly pass laws that someone else will pay for it.

...

The bail out bill was billed as a way to protect the market. Obama intoned that those of us who were against it wanted the market to fall. The markets have been in free fall ever since Obama got his bail out bill, in the form he wanted it with TAX CUTS TAX CUTS TAX CUTS. Clearly his judgment on the economy needs some more development. What the Pillsbury Doughboy and his all moose orchestra think about the economy is beside the point. McCain is on every side of every issue, except that we know he is against doing anything which does anything, and his running mate is against ever allowing a black person to have any money, ever, under any circumstances. Politics is often the choice between the unpalatable and the disastrous, but right now, we don't even have the unpalatable on the ballot. Just the disastrous and the catastrophic.

Saturday, October 11, 2008

Friday, October 10, 2008

Roubini: We're Headed For The Shitter

I'm not big into doom scenarios, but this dude's been on the mark every time I've read him in the past months, and if he's going "The world is at severe risk of a global systemic financial meltdown and a severe global depression" then I can't really argue..

Well, its been nice. Today's 7% loss on Wall Street puts us a good 40% down since last year's all time high.

The US and advanced economies’ financial system is now headed towards a near-term systemic financial meltdown as day after day stock markets are in free fall, money markets have shut down while their spreads are skyrocketing, and credit spreads are surging through the roof. There is now the beginning of a generalized run on the banking system of these economies; a collapse of the shadow banking system, i.e. those non-banks (broker dealers, non-bank mortgage lenders, SIV and conduits, hedge funds, money market funds, private equity firms) that, like banks, borrow short and liquid, are highly leveraged and lend and invest long and illiquid and are thus at risk of a run on their short-term liabilities; and now a roll-off of the short term liabilities of the corporate sectors that may lead to widespread bankruptcies of solvent but illiquid financial and non-financial firms.

...

The crisis was caused by the largest leveraged asset bubble and credit bubble in the history of humanity were excessive leveraging and bubbles were not limited to housing in the US but also to housing in many other countries and excessive borrowing by financial institutions and some segments of the corporate sector and of the public sector in many and different economies: an housing bubble, a mortgage bubble, an equity bubble, a bond bubble, a credit bubble, a commodity bubble, a private equity bubble, a hedge funds bubble are all now bursting at once in the biggest real sector and financial sector deleveraging since the Great Depression.

At this point the recession train has left the station; the financial and banking crisis train has left the station. The delusion that the US and advanced economies contraction would be short and shallow – a V-shaped six month recession – has been replaced by the certainty that this will be a long and protracted U-shaped recession that may last at least two years in the US and close to two years in most of the rest of the world. And given the rising risk of a global systemic financial meltdown the probability that the outcome could become a decade long L-shaped recession – like the one experienced by Japan after the bursting of its real estate and equity bubble – cannot be ruled out.

And in a world where there is a glut and excess capacity of goods while aggregate demand is falling soon enough we will start to worry about deflation, debt deflation, liquidity traps and what monetary policy makers should do to fight deflation when policy rates get dangerously close to zero.

At this point the risk of an imminent stock market crash – like the one-day collapse of 20% plus in US stock prices in 1987 – cannot be ruled out as the financial system is breaking down, panic and lack of confidence in any counterparty is sharply rising and the investors have totally lost faith in the ability of policy authorities to control this meltdown.

Well, its been nice. Today's 7% loss on Wall Street puts us a good 40% down since last year's all time high.

Thursday, October 09, 2008

Powerful

Richard Trumka, United Steelworkers, for the Win..

Watch. Really.

Watch. Really.

When All Else Literally Fails...

Looks like Paulson is desperately nudging things toward the Swedish banking model of direct capital investment - with equity stakes - of the banking system, and more front door than back.

Wednesday, October 08, 2008

I'm Tellin' Ya..

They're freaking right the fuck out..

Angered by a delay in the receipt of his voter registration card, a Louisiana man today threatened election officials, claiming that he urgently needed to cast a ballot to "keep the nigger out of office," according to police. Wade Williams, 75, was arrested this morning on a felony terrorizing charge after allegedly calling the Registrar of Voters and warning that he would come to the state office and empty his shotgun unless he got his registration card. Using profanity and racial slurs, Williams told a state official "about needing to vote to 'keep the nigger out of office"..

"My Fellow Prisoners.."

Well, theoretically I guess we're all in this handbasket together..

Tuesday, October 07, 2008

And I Have To Fear...

Lets face it - as much as I respect the seemingly dwindling core value old school fiscal conservative republican, the pandering to the wingnut right over the years has brought the R's to be synonymous with intolerance. If there's a generic anti-gay or racist or overzealous base of hatred, it's likely from that end of the spectrum.

And what we've started to see in the last few days at Palin appearances and McCain gatherings is the rearing of some of those ugly heads - people on the fringes of the message who have been sucked into the herd because they have a vote to offer are starting to come to the surface as they realize that, barring a major swing in momentum, they are about to be returned to outside as a black man with a tolerant humanitarian agenda may likely become president.

They have about a month left to be heard within the realm of discourse, and then I fear they will attempt to be heard outside the discourse once they are unrepresented.

And what we've started to see in the last few days at Palin appearances and McCain gatherings is the rearing of some of those ugly heads - people on the fringes of the message who have been sucked into the herd because they have a vote to offer are starting to come to the surface as they realize that, barring a major swing in momentum, they are about to be returned to outside as a black man with a tolerant humanitarian agenda may likely become president.

They have about a month left to be heard within the realm of discourse, and then I fear they will attempt to be heard outside the discourse once they are unrepresented.

I Have To Wonder...

...if McCains all-or-nothing dive into the sleaze may cost him not only this presidential campaign, but perhaps his Arizona Senate seat in 2010..

Monday, October 06, 2008

Some Much Needed Diversionary Awesome

Petra Hayden, featuring Petra Hayden, Petra Hayden, Petra Hayden, Petra Hayden, Petra Hayden, Petra Hayden, Petra Hayden, Petra Hayden, Petra Hayden, and special guest Petra Hayden.

Outrage. Broken.

Looks like the wingnuts want to go down swinging. Or whatever else they can think of.

Scary times, y'all.

Scary times, y'all.

An Example Of Why This Blog Has This Name..

Nothing is surprising anymore..

And of course, the whole point...

Fuck you congress.

The now-bankrupt investment bank Lehman Brothers arranged millions in bonuses for fired executives as it pleaded for a federal lifeline, lawmakers learned Monday, as Congress began investigating what went so wrong on Wall Street to prompt a $700 billion government bailout.

...Richard S. Fuld Jr., the Lehman chief executive ... sat for a two-hour-plus grilling before the House Oversight and Government Reform Committee as the panel combed through his pay history, management practices and financial strategies.

"You made all this money by taking risks with other people's money," Rep. Henry Waxman, D-Calif., the panel's chairman, said. "The system worked for you, but it didn't seem to work for the rest of the country and the taxpayers, who now have to pay $700 billion to bail out our economy."

A subdued Fuld opened his testimony declaring, "I take full responsibility for the decisions that I made and for the actions that I took," but he conceded no errors or misjudgments in the chaotic period that led to the firm's bankruptcy.

And he said a compensation system that he estimated paid him about $350 million between 2000 and 2007 even as the company headed for disaster was appropriate.

"We had a compensation committee that spent a tremendous amount of time making sure that the interests of the executives and the employees were aligned with shareholders," Fuld said.

That wasn't good enough for some lawmakers who decried what they called a culture of entitlement at Lehman even as the company's performance nosedived.

The panel unearthed internal documents showing that on Sept. 11, Lehman planned to approve "special payments" worth $18.2 million for two executives who were terminated involuntarily, and another $5 million for one who was leaving on his own.

That was just four days before the government let Lehman go under, touching off a cascading series of financial shocks and failures that put Washington on track for the multibillion-dollar rescue the Bush administration urgently requested from Congress at the end of that week.

On Wall Street, uncertainty Monday about the effectiveness of the rescue sent the Dow Jones industrials sinking below 10,000 for the first time in four years. Investors fear the crisis will weigh down the global economy and the bailout won't work quickly to loosen credit markets.

And of course, the whole point...

The bailout, now law, was so rushed that the usual congressional scrutiny is only coming now, after the fact.

Fuck you congress.

Sunday, October 05, 2008

The Battle For.. Omaha?

FiveThirtyEight.com explains why Obama is running essentially a one-city campaign in Nebraska and why McCain was forced to send Skipper to counter.

Sunday Football Observation

Last year's worst team, the Miami Dolphins, are having a whole lot of fun playing this year.

Quote O' The Day

"There is only one thing necessary to understanding what is happening and it is this: no one at U.S. Banks, no one at the Federal Reserve and no one in politics can accept the reality that real estate assets in this country remain oversupplied, overpriced and overleveraged."

Kevin Depew at Minyanville.com

Make-Believe Maverick

Rolling Stone's Tim Dickinson takes a "closer look at the life and career of John McCain reveals a disturbing record of recklessness and dishonesty"...

This is the story of the real John McCain, the one who has been hiding in plain sight. It is the story of a man who has consistently put his own advancement above all else, a man willing to say and do anything to achieve his ultimate ambition: to become commander in chief, ascending to the one position that would finally enable him to outrank his four-star father and grandfather.

In its broad strokes, McCain's life story is oddly similar to that of the current occupant of the White House. John Sidney McCain III and George Walker Bush both represent the third generation of American dynasties. Both were born into positions of privilege against which they rebelled into mediocrity. Both developed an uncanny social intelligence that allowed them to skate by with a minimum of mental exertion. Both struggled with booze and loutish behavior. At each step, with the aid of their fathers' powerful friends, both failed upward. And both shed their skins as Episcopalian members of the Washington elite to build political careers as self-styled, ranch-inhabiting Westerners who pray to Jesus in their wives' evangelical churches.

In one vital respect, however, the comparison is deeply unfair to the current president: George W. Bush was a much better pilot.

...

Indeed, many leading Republicans who once admired McCain see his recent contortions to appease the GOP base as the undoing of a maverick. "John McCain's ambition overrode his basic character," says Rita Hauser, who served on the President's Foreign Intelligence Advisory Board from 2001 to 2004. But the truth of the matter is that ambition is John McCain's basic character. Seen in the sweep of his seven-decade personal history, his pandering to the right is consistent with the only constant in his life: doing what's best for himself. To put the matter squarely: John McCain is his own special interest.

"John has made a pact with the devil," says Lincoln Chafee, the former GOP senator, who has been appalled at his one-time colleague's readiness to sacrifice principle for power. Chafee and McCain were the only Republicans to vote against the Bush tax cuts. They locked arms in opposition to drilling in the Arctic National Wildlife Refuge. And they worked together in the "Gang of 14," which blocked some of Bush's worst judges from the federal bench.

"On all three — sadly, sadly, sadly — McCain has flip-flopped," Chafee says. And forget all the "Country First" sloganeering, he adds. "McCain is putting himself first. He's putting himself first in blinking neon lights."

...

"I enjoyed the off-duty life of a Navy flier more than I enjoyed the actual flying," McCain writes. "I drove a Corvette, dated a lot, spent all my free hours at bars and beach parties." McCain chased a lot of tail. He hit the dog track. Developed a taste for poker and dice. He picked up models when he could, screwed a stripper when he couldn't.

In the air, the hard-partying McCain had a knack for stalling out his planes in midflight. He was still in training, in Texas, when he crashed his first plane into Corpus Christi Bay during a routine practice landing. The plane stalled, and McCain was knocked cold on impact. When he came to, the plane was underwater, and he had to swim to the surface to be rescued. Some might take such a near-death experience as a wake-up call: McCain took some painkillers and a nap, and then went out carousing that night.

Off duty on his Mediterranean tours, McCain frequented the casinos of Monte Carlo, cultivating his taste for what he calls the "addictive" game of craps. McCain's thrill-seeking carried over into his day job. Flying over the south of Spain one day, he decided to deviate from his flight plan. Rocketing along mere feet above the ground, his plane sliced through a power line. His self-described "daredevil clowning" plunged much of the area into a blackout.

That should have been the end of McCain's flying career. "In the Navy, if you crashed one airplane, nine times out of 10 you would lose your wings," says Butler, who, like his former classmate, was shot down and taken prisoner in North Vietnam. Spark "a small international incident" like McCain had? Any other pilot would have "found themselves as the deck officer on a destroyer someplace in a hurry," says Butler.

"But, God, he had family pull. He was directly related to the CEO — you know?"

McCain was undeterred by the crashes. Nearly a decade out of the academy, his career adrift, he decided he wanted to fly combat in Vietnam. His motivation wasn't to contain communism or put his country first. It was the only way he could think of to earn the respect of the man he calls his "distant, inscrutable patriarch." He needed to secure a command post in the Navy — and to do that, his career needed the jump-start that only a creditable war record could provide.

As he would so many times in his career, McCain pulled strings to get ahead. After a game of tennis, McCain prevailed upon the undersecretary of the Navy that he was ready for Vietnam, despite his abysmal flight record. Sure enough, McCain was soon transferred to McCain Field — an air base in Meridian, Mississippi, named after his grandfather — to train for a post on the carrier USS Forrestal.

With a close friend at the base, an alcoholic Marine captain, McCain formed the "Key Fess Yacht Club," which quickly became infamous for hosting toga parties in the officers' quarters and bringing bands down from Memphis to attract loose women to the base. Showing his usual knack for promotion, McCain rose from "vice commodore" to "commodore" of the club.

...

That December, McCain crashed again. Flying back from Philadelphia, where he had joined in the reverie of the Army-Navy football game, McCain stalled while coming in for a refueling stop in Norfolk, Virginia. This time he managed to bail out at 1,000 feet. As his parachute deployed, his plane thundered into the trees below.

By now, however, McCain's flying privileges were virtually irrevocable — and he knew it. On one of his runs at McCain Field, when ground control put him in a holding pattern, the lieutenant commander once again pulled his family's rank. "Let me land," McCain demanded over his radio, "or I'll take my field and go home!"

...

It was July 29th, 1967, a hot, gusty morning in the Gulf of Tonkin atop the four-acre flight deck of the supercarrier USS Forrestal. Perched in the cockpit of his A-4 Skyhawk, Lt. Cmdr. John McCain ticked nervously through his preflight checklist.

Now 30 years old, McCain was trying to live up to his father's expectations, to finally be known as something other than the fuck-up grandson of one of the Navy's greatest admirals. That morning, preparing for his sixth bombing run over North Vietnam, the graying pilot's dreams of combat glory were beginning to seem within his reach.

Then, in an instant, the world around McCain erupted in flames. A six-foot-long Zuni rocket, inexplicably launched by an F-4 Phantom across the flight deck, ripped through the fuel tank of McCain's aircraft. Hundreds of gallons of fuel splashed onto the deck and came ablaze. Then: Clank. Clank. Two 1,000-pound bombs dropped from under the belly of McCain's stubby A-4, the Navy's "Tinkertoy Bomber," into the fire.

McCain, who knew more than most pilots about bailing out of a crippled aircraft, leapt forward out of the cockpit, swung himself down from the refueling probe protruding from the nose cone, rolled through the flames and ran to safety across the flight deck. Just then, one of his bombs "cooked off," blowing a crater in the deck and incinerating the sailors who had rushed past McCain with hoses and fire extinguishers. McCain was stung by tiny bits of shrapnel in his legs and chest, but the wounds weren't serious; his father would later report to friends that Johnny "came through without a scratch."

The damage to the Forrestal was far more grievous: The explosion set off a chain reaction of bombs, creating a devastating inferno that would kill 134 of the carrier's 5,000-man crew, injure 161 and threaten to sink the ship.

These are the moments that test men's mettle. Where leaders are born. Leaders like . . . Lt. Cmdr. Herb Hope, pilot of the A-4 three planes down from McCain's. Cornered by flames at the stern of the carrier, Hope hurled himself off the flight deck into a safety net and clambered into the hangar deck below, where the fire was spreading. According to an official Navy history of the fire, Hope then "gallantly took command of a firefighting team" that would help contain the conflagration and ultimately save the ship.

McCain displayed little of Hope's valor. Although he would soon regale The New York Times with tales of the heroism of the brave enlisted men who "stayed to help the pilots fight the fire," McCain took no part in dousing the flames himself. After going belowdecks and briefly helping sailors who were frantically trying to unload bombs from an elevator to the flight deck, McCain retreated to the safety of the "ready room," where off-duty pilots spent their noncombat hours talking trash and playing poker. There, McCain watched the conflagration unfold on the room's closed-circuit television — bearing distant witness to the valiant self-sacrifice of others who died trying to save the ship, pushing jets into the sea to keep their bombs from exploding on deck.

...

The fire blazed late into the night. The following morning, while oxygen-masked rescue workers toiled to recover bodies from the lower decks, McCain was making fast friends with R.W. "Johnny" Apple of The New York Times, who had arrived by helicopter to cover the deadliest Naval calamity since the Second World War. The son of admiralty surviving a near-death experience certainly made for good copy, and McCain colorfully recounted how he had saved his skin. But when Apple and other reporters left the ship, the story took an even stranger turn: McCain left with them. As the heroic crew of the Forrestal mourned its fallen brothers and the broken ship limped toward the Philippines for repairs, McCain zipped off to Saigon for what he recalls as "some welcome R&R."

Saturday, October 04, 2008

Greed

Turns out Paulson is essentially attempting to bail out his own mistake..

Many events in Washington, on Wall Street and elsewhere around the country have led to what has been called the most serious financial crisis since the 1930s. But decisions made at a brief meeting on April 28, 2004, explain why the problems could spin out of control. The agency’s failure to follow through on those decisions also explains why Washington regulators did not see what was coming.

On that bright spring afternoon, the five members of the Securities and Exchange Commission met in a basement hearing room to consider an urgent plea by the big investment banks.

They wanted an exemption for their brokerage units from an old regulation that limited the amount of debt they could take on. The exemption would unshackle billions of dollars held in reserve as a cushion against losses on their investments. Those funds could then flow up to the parent company, enabling it to invest in the fast-growing but opaque world of mortgage-backed securities; credit derivatives, a form of insurance for bond holders; and other exotic instruments.

The five investment banks led the charge, including Goldman Sachs, which was headed by Henry M. Paulson Jr. Two years later, he left to become Treasury secretary.

...

After 55 minutes of discussion, which can now be heard on the Web sites of the agency and The Times, the chairman, William H. Donaldson, a veteran Wall Street executive, called for a vote. It was unanimous. The decision, changing what was known as the net capital rule, was completed and published in The Federal Register a few months later.

With that, the five big independent investment firms were unleashed.

In loosening the capital rules, which are supposed to provide a buffer in turbulent times, the agency also decided to rely on the firms’ own computer models for determining the riskiness of investments, essentially outsourcing the job of monitoring risk to the banks themselves.

Over the following months and years, each of the firms would take advantage of the looser rules. At Bear Stearns, the leverage ratio — a measurement of how much the firm was borrowing compared to its total assets — rose sharply, to 33 to 1. In other words, for every dollar in equity, it had $33 of debt. The ratios at the other firms also rose significantly.

The 2004 decision for the first time gave the S.E.C. a window on the banks’ increasingly risky investments in mortgage-related securities.

...

The commission assigned seven people to examine the parent companies — which last year controlled financial empires with combined assets of more than $4 trillion. Since March 2007, the office has not had a director. And as of last month, the office had not completed a single inspection since it was reshuffled by Mr. Cox more than a year and a half ago.

...

The commission’s decision effectively to outsource its oversight to the firms themselves fit squarely in the broader Washington culture of the last eight years under President Bush.

A similar closeness to industry and laissez-faire philosophy has driven a push for deregulation throughout the government, from the Consumer Product Safety Commission and the Environmental Protection Agency to worker safety and transportation agencies.

“It’s a fair criticism of the Bush administration that regulators have relied on many voluntary regulatory programs,” said Roderick M. Hills, a Republican who was chairman of the S.E.C. under President Gerald R. Ford. “The problem with such voluntary programs is that, as we’ve seen throughout history, they often don’t work.”

As was the case with other agencies, the commission’s decision was motivated by industry complaints of excessive regulation at a time of growing competition from overseas.

...

“We foolishly believed that the firms had a strong culture of self-preservation and responsibility and would have the discipline not to be excessively borrowing,” said Professor James D. Cox, an expert on securities law and accounting at Duke School of Law (and no relationship to Christopher Cox).

“Letting the firms police themselves made sense to me because I didn’t think the S.E.C. had the staff and wherewithal to impose its own standards and I foolishly thought the market would impose its own self-discipline. We’ve all learned a terrible lesson,” he added.

...

A once-proud agency with a rich history at the intersection of Washington and Wall Street, the Securities and Exchange Commission was created during the Great Depression as part of the broader effort to restore confidence to battered investors. It was led in its formative years by heavyweight New Dealers, including James Landis and William O. Douglas. When President Franklin D. Roosevelt was asked in 1934 why he appointed Joseph P. Kennedy, a spectacularly successful stock speculator, as the agency’s first chairman, Roosevelt replied: “Set a thief to catch a thief.”

Last Friday, the commission formally ended the 2004 program, acknowledging that it had failed to anticipate the problems at Bear Stearns and the four other major investment banks.

“The last six months have made it abundantly clear that voluntary regulation does not work,” Mr. Cox said.

Friday, October 03, 2008

Thursday, October 02, 2008

All The Rage

John McCain is apparently popping from Romo's stash...

Ya Know

Before we witnessed it in living color tonight, one of Palin's former debate opponents had deemed her the master of the non-answer...

Wednesday, October 01, 2008

Ohana

VirgoTex has a great post up over at First Draft where she points out a very prescient view by CityMama at Momocrats Blog:

Read the whole post - great points all around, including a guest appearance by Roger Ebert..

Having grown up in Hawaii, I know the community that surrounded him. It wasn't just his family or his school, but the entire island surrounding him with the spirit of ohana or family. In Hawaii, ohana means the entire community, the whole island, is your family in that "it takes a village" sense. It means that you may disagree with someone, even vehemently, but since you live on a rock in the middle of the Pacific Ocean and you can't run away from them, you need to figure out a way to live and work together. I saw Obama's "Hawaii-ness"—his spirit of ohana—in Friday's debate.

I saw it when Obama said, "John McCain is right," finding the rare points where he could agree with McCain before roasting him in a blaze of searing criticism. Obama's agreement didn't show weakness. On the contrary. People everywhere,—but especially people from Hawaii—understand that it showed leadership, a willingness to reach across the aisle in the spirit of working together, it showed Obama's true nature as someone who can seek common ground where he is able, it showed ohana.

In Hawaii, perhaps because of the spirit of ohana or the Missionary influence or deep-rooted Asian traditions, a high social value is placed on respecting elders and being polite. It's the island way. Grace, gentlemanliness, and courtesy are social norms. Anyone acting otherwise is an instant pariah. If you are discourteous, everyone knows who you are. To further illustrate my point, I would venture to say that everyone from Hawaii watching the debate was thinking, "Yes, he had to take McCain down 17 notches, but at least he showed manners and acted like a gentleman. He wasn't rude. His family raised him right."

Read the whole post - great points all around, including a guest appearance by Roger Ebert..

After All, It Is A Holiday

I tuned into VH1 Classic on Monday night after the Steelers game and tripped over something called "Rush Hashanah", a 24 hour video tribute to my favorite band when i was in high school.

Since that's about the absolute tackiest (and borderline blasphemous) manner in which to present something I kinda like, I thought I'd reintroduce this astounding piece of What-The-Hell. I call and raise with this:

You're welcome.

Since that's about the absolute tackiest (and borderline blasphemous) manner in which to present something I kinda like, I thought I'd reintroduce this astounding piece of What-The-Hell. I call and raise with this:

You're welcome.

The Counterstrike

Dem objectors to the bailout plan (like Marcy!) are teaming with some of the fiscal conservative Repugs that gave Paulson and GOP leadership the finger to work on Something Completely Different.

Tuesday, September 30, 2008

OK, Let Me Get This Straight

Our government wants $700 billion to basically bail out the five major banks remaining that have volatile portfolios, while the Fed has spewed $650 Billion in inflationary cash into the global markets on top of that, and yet the people who got bagged into bad mortgages and loans and the people in general can't be afforded a single thing?

There hasn't been one official word from anyone about helping the victims of this crisis - the talk of keeping the taxpayers in mind when it comes to the bailout is all about attempting to minimize our risk in giving the banks our money, not in getting anything for ourselves.

No money, no relief, no programs, no assistance. No infrastructure, no energy, no transportation, no health care, no education programs, no anything. $1.3 Trillion created out of the ether after years of claiming poverty and yet none of it benefits any of us. Instead, if we're lucky, we might get some of it back so it can go back to not being used to fix things.

No respect. I've said it before - the individual consumer has no place in the American government anymore - only the dollar and the corporation matter.

There hasn't been one official word from anyone about helping the victims of this crisis - the talk of keeping the taxpayers in mind when it comes to the bailout is all about attempting to minimize our risk in giving the banks our money, not in getting anything for ourselves.

No money, no relief, no programs, no assistance. No infrastructure, no energy, no transportation, no health care, no education programs, no anything. $1.3 Trillion created out of the ether after years of claiming poverty and yet none of it benefits any of us. Instead, if we're lucky, we might get some of it back so it can go back to not being used to fix things.

No respect. I've said it before - the individual consumer has no place in the American government anymore - only the dollar and the corporation matter.

Monday, September 29, 2008

Bottom Line

Joseph Stiglitz, in The Nation...

The administration is once again holding a gun at our head, saying, "My way or the highway." We have been bamboozled before by this tactic. We should not let it happen to us again. There are alternatives. Warren Buffet showed the way, in providing equity to Goldman Sachs. The Scandinavian countries showed the way, almost two decades ago. By issuing preferred shares with warrants (options), one reduces the public's downside risk and insures that they participate in some of the upside potential. This approach is not only proven, it provides both incentives and wherewithal to resume lending. It furthermore avoids the hopeless task of trying to value millions of complex mortgages and even more complex products in which they are embedded, and it deals with the "lemons" problem--the government getting stuck with the worst or most overpriced assets.

...

If we design the right bailout, it won't lead to an increase in our long-term debt--we might even make a profit. But if we implement the wrong strategy, there is a serious risk that our national debt--already overburdened from a failed war and eight years of fiscal profligacy--will soar, and future living standards will be compromised. The president seemed to think that his new shell game will arrest the decline in house prices, and we won't be faced holding a lot of bad mortgages. I hope he's right, but I wouldn't count on it: it's not what most housing experts say. The president's economic credentials are hardly stellar. Our national debt has already climbed from $5.7 trillion to over $9 trillion in eight years, and the deficits for 2008 and 2009--not including the bailouts--are expected to reach new heights. There is no such thing as a free war--and no such thing as a free bailout. The bill will be paid, in one way or another.

Quote O' The Day

The pattern here is perfectly clear. McCain has contempt for anybody who stands between him and the presidency. McCain views himself as the ultimate patriot. He loves his country so much that he cannot let it fall into the hands of an unworthy rival. (They all turn out to be unworthy.) Viewed in this way, doing whatever it takes to win is not an act of selfishness but an act of patriotism. McCain tells lies every day and authorizes lying on his behalf, and he probably knows it. But I would guess--and, again, guessing is all we can do--that in his mind he is acting honorably. As he might put it, there is a bigger truth out there.

-- Jonathan Chait, The New Republic

Intercepted

Wachovia was about to hit the WaMu, only to be saved by a purchase agreement with Citigroup for $1 per share...

Uh huh.

“Wachovia did not fail,” the F.D.I.C. said, “rather it is to be acquired by Citigroup Inc. on an open-bank basis with assistance from the F.D.I.C.”

Uh huh.

Sunday, September 28, 2008

Follow The Money

Josh Marshall finds more money connection between the McCain campaign and Rick Davis' companies,including a $3 million retainer for a web design company that doesn't seem to do anything.

Saturday, September 27, 2008

Dumb Thought

Tina Fey's impression of Sarah Palin, phonetically, is basically Dana Carvey's impression of Walter Mondale.

Quote O' The Day

Rolling Stone's Matt Taibbi, in the not-yet online October 2nd issue, on Palin..

(Jazz From Hell)

"Here's the thing about Americans. You can send their kids off by the thousands to get their balls blown off in foreign lands for no reason at all, saddle them with billions in debt year after congressional year while they spend their winters cheerfully watching game shows and football, pull the rug out from under their mortgages, and leave them living off their credit cards and their Wal-Mart salaries while you move their jobs to China and Bangalore.

"And none of it matters, so long as you remember a few months before Election Day to offer them a two-bit caricature culled from some cutting-room-floor episode of Roseanne as part of your presidential ticket. And if she's a good enough likeness of a loudmouthed Middle American archetype, as Sarah Palin is, John Q. Public will drop his giant sized bag of Doritos in gratitude, wipe the sizzlin' picante dust from his lips and rush to the booth to vote for her. Not because it makes sense, or because it has a chance of improving his life or anyone else's, but simply because it appeals to the low-humming narcissism that substitutes for his personality, because that image on TV reminds him of the mean brainless slob he sees in the mirror every morning.

"Sarah Palin is a symbol of everything that is wrong with the modern United States. As a representative of our political system, she's a new low in reptilian villainy, the ultimate cynical masterwork of puppeteers like Karl Rove. But more than that, she is a horrifying symbol of how little we ask for in return for the total surrender of our political power. Not only is Sarah Palin a fraud, she's the tawdriest, most half-assed fraud imaginable, 20 floors below the lowest common denominator, a character too dumb even for daytime TV – and this country is going to eat her up, cheering every step of the way. All because most Americans no longer have the energy to do anything but lie back and allow ourselves to be jacked off by the calculating thieves who run this grasping consumer paradise we call a nation."

(Jazz From Hell)

Something To Look Forward To

Its becoming pretty clear that, as the American banking sector prepares for the unlikely event of a water landing and the dollar becomes mostly dead, financial officials in other countries are pretty well convinced that the US is not long from ceasing to be a major player at all in international economics, let alone a superpower.

The big sacrifice from a political standpoint may end up being influence. Countries on the Euro and major players like China have isolated themselves fairly effectively from the plummet of our system and the nosedive of the dollar by minding their own business, in every sense of the term.

The big sacrifice from a political standpoint may end up being influence. Countries on the Euro and major players like China have isolated themselves fairly effectively from the plummet of our system and the nosedive of the dollar by minding their own business, in every sense of the term.

West Winging It

Josh is right - this Weisman article on McCain's march on Washington is a fascinating read...

And kudos to the Dems for actually executing a plan.. its been a while.

And kudos to the Dems for actually executing a plan.. its been a while.

One Republican in the room said it was clear that the Democrats came into the meeting with a "game plan" aimed at forcing McCain to choose between the administration and House Republicans. "They had taken McCain's request for a meeting and trumped it," said this source.

Friday, September 26, 2008

Beat The Crowd

Stay Classy, DPD..

The front of the black shirt shows the number "68" with a slash through it. One of the primary protest groups at last month's DNC in Denver called themselves "Recreate 68," harkening back to the violent, 1968 political convention in Chicago.

The back of the shirt features a menacing-looking police figure, wearing what looks like a Denver police badge and helmet and clutching a baton. He's looming over the city of Denver along with the slogan, "WE GET UP EARLY, to BEAT the crowds." Also written across the back of the shirt is "2008 DNC.'

...

"I want an answer," (Seth) Barnett wrote, "of why they take the harm of our citizens and guests as a joke." He said he thinks the shirts are a poor representation of the city and its police force.

There were 154 protestors arrested during the August convention; many taken into custody following a Monday night melee with police along 15th Street.

The Denver police detective who produced the shirts, Det. Nick Rogers, says he has received no complaints until now. He said the shirts are being sold for $10 each at the Police Protective Association Offices.

...

He said the PPA will likely sell a couple thousand of the shirts. They went on sale following the convention and he said every Denver police officer was given one free. Beyond that, he said officers from other departments like Lakewood police and the Jefferson County Sheriffs Department have been clamoring for the shirts and have ordered dozens more. He said after the initial printing, there was so much demand he had to reorder more shirts.

Thursday, September 25, 2008

Recreate '68?

Uh... why is the Army assigning an entire brigade to domestic assignment, including training for non-lethal engagement?

As Greenwald mentions in Update II, it reeks of bad precedent, first and foremost.

As Greenwald mentions in Update II, it reeks of bad precedent, first and foremost.

Disembodied Heads

Your favorite heads on what the hell they think McCain is trying to accomplish with all that suspension crap..

Pants Afire

Newsweek's Michael Isikoff is pretty damn sure Rick Davis is still on the books at Davis Manafort despite myriad statements to the contrary by McCain heads.

Meanwhile, McCain is trying to use the dire emergency to shitcan the first scheduled debate, a laughable ploy Obama is having no part of.

Stirling Newberry, who can be found on several collective blogs as an economic expert, sums up the road to here over at Firedoglake.

Meanwhile, McCain is trying to use the dire emergency to shitcan the first scheduled debate, a laughable ploy Obama is having no part of.

Stirling Newberry, who can be found on several collective blogs as an economic expert, sums up the road to here over at Firedoglake.

Wednesday, September 24, 2008

Deep Thought

A platform republican who wasn't buried in lies and scandal and who actually truly and honestly ran on core republican values of fiscal conservativism and smaller government without waving Jebus and reproductive and marriage rights in my face could probably have my vote this year. If there were such a thing.

Ed Stein

Too True

Ed Stein Rocky Mountain News Sep 24, 2008 |

Dave!

from Drudge, who doesn't really need to be linked..

EXCLUSIVE: LETTERMAN MOCKS MCCAIN CANCELLATION

Wed Sep 24 2008 17:41:58 ET

David Letterman tells audience that McCain called him today to tell him he had to rush back to DC to deal with the economy.

Then in the middle of the taping Dave got word that McCain was, in fact just down the street being interviewed by Katie Couric. Dave even cut over to the live video of the interview, and said, "Hey Senator, can I give you a ride home?"

Earlier in the show, Dave kept saying, "You don't suspend your campaign. This doesn't smell right. This isn't the way a tested hero behaves." And he joked: "I think someone's putting something in his metamucil."

"He can't run the campaign because the economy is cratering? Fine, put in your second string quarterback, Sara Palin. Where is she?"

"What are you going to do if you're elected and things get tough? Suspend being president? We've got a guy like that now!"

The Reanimator

Looks like lipstick on a pig runs around $5 grand..

Tuesday, September 23, 2008

There Is No 'Crisis'...

... just a heist. A few questions need to be answered before anybody gives anyone anything..

Sunday, September 21, 2008

I Love Athenae

A. gets right to the outrage part..

Where was our country when our countrymen needed it most?

Where was the state of emergency, now occurring because the economy is melting from the top down, when it was crumbling from the bottom up?

Where were the demands we shove $700 billion into rebuilding this country, so that people could get to work, so that people could get to school, so that people could live in ways that wouldn't shame us when we were occasionally forced to look ourselves in the face, where was the willingness of Congress to work weekends then?

... it's not that I don't get it. On the contrary. I and most of the rest of America have been getting it for years. Getting it good and hard, in fact, and you couldn't pay anybody currently having a freakout to care.

I Prefer The Word 'Heist'..

..but William Greider is perfectly content with 'swindle'..

Financial-market wise guys, who had been seized with fear, are suddenly drunk with hope. They are rallying explosively because they think they have successfully stampeded Washington into accepting the Wall Street Journal solution to the crisis: dump it all on the taxpayers. That is the meaning of the massive bailout Treasury Secretary Henry Paulson has shopped around Congress. It would relieve the major banks and investment firms of their mountainous rotten assets and make the public swallow their losses--many hundreds of billions, maybe much more. What's not to like if you are a financial titan threatened with extinction?

If Wall Street gets away with this, it will represent an historic swindle of the American public--all sugar for the villains, lasting pain and damage for the victims. My advice to Washington politicians: Stop, take a deep breath and examine what you are being told to do by so-called "responsible opinion." If this deal succeeds, I predict it will become a transforming event in American politics--exposing the deep deformities in our democracy and launching a tidal wave of righteous anger and popular rebellion.

...

If government acts responsibly, it will impose some other conditions on any broad rescue for the bankers. First, take due bills from any financial firms that get to hand off their spoiled assets, that is, a hard contract that repays government from any future profits once the crisis is over. Second, when the politicians get around to reforming financial regulations and dismantling the gimmicks and "too big to fail" institutions, Wall Street firms must be prohibited from exercising their usual manipulations of the political system. Call off their lobbyists, bar them from the bribery disguised as campaign contributions.

...

More important, if the taxpayers are compelled to refinance the villains in this drama, then Americans at large are entitled to equivalent treatment in their crisis. That means the suspension of home foreclosures and personal bankruptcies for debt-soaked families during the duration of this crisis. The debtors will not escape injury and loss--their situation is too dire--but they deserve equal protection from government, the chance to work out things gradually over some years on reasonable terms.

...

The agenda is staggering. The United States is ill equipped to deal with it smartly, not to mention wisely...

Saturday, September 20, 2008

Credit Crunch

A very good NYT article on how the tightening of credit has affected all levels of consumerism from loans to credit cards to classified sales and auctions.

No End In Sight

CalculatedRisk, the site that originally blogged the leaked bailout plan, reacts to the NYT's assertion that taxpayers may profit from the plan at some point.

The referenced section of the plan, verbatim:

The plan only limits the Treasury to "$700,000,000,000 outstanding at any one time", so the total purchases can exceed $700 billion. In fact, every time the Treasury sells some securities, they will probably plow the net proceeds back into more troubled assets until the entire $700 billion is gone.

Think of a drunk gambler at a slot machine. He starts with $100 and slowly loses. Every now and then he wins some money, but he keeps putting the coins back into the slot until he has lost everything. That is how this plan will work.

The referenced section of the plan, verbatim:

Sec. 6. Maximum Amount of Authorized Purchases.

The Secretary’s authority to purchase mortgage-related assets under this Act shall be limited to $700,000,000,000 outstanding at any one time

This Is Not Your Older Brother's Bank Crisis..

Josh Marshall points to The Post's Sebastian Mallaby, who explains why this proposed bailout is entirely different from the S&L crisis process..

In the 1980s, the government did not need a strategy to decide which bad loans to take over; it dealt with anything that fell into its lap as a result of a thrift bankruptcy. But under the current proposal, the government would go out and shop for bad loans. These come in all shapes and sizes, so the government would have to judge what type of loans it wants. They are illiquid, so it's hard to know how to value them. Bad loans are weighing down the financial system precisely because private-sector experts can't determine their worth. The government would have no better handle on the problem.

In practice this means the government would make subjective choices about which bad loans to buy, and it would pay more than fair value. Billions in taxpayer money would be transferred to the shareholders and creditors of banks, and the banks from which the government bought most loans would be subsidized more than their rivals. If the government bought the most from the sickest institutions, it would be slowing the healthy process in which strong players buy up the weak, delaying an eventual recovery. The haggling over which banks got to unload the most would drag on for months. So the hope that this "systematic" plan can be a near-term substitute for ad hoc AIG-style bailouts is illusory.

...

Taking bad loans off the shoulders of the banks seems like a merciful rescue; ordering banks to raise capital or buying equity stakes in them sounds like big-government meddling. But we are in the midst of a crisis, and it shouldn't matter how things sound. The Treasury plan outlined on Friday involves vast risks to taxpayers, huge complexity and no guarantee of success. There are better ways forward.

Liquidity vs. Insolvency

Paul Krugman explains why the blank-check bailout looks more like an end-around than a solution..

I'm no expert, not even close. But if this crisis amounts to throwing money at otherwise technically solvent banks before they fail because they can't generate liquidity, and that phantom liquidity proceeds without reform or regulation and leads to insolvency anyway, then this bailout is just a $700 Billion golden parachute that protects only the ones who created the problem in the first place.

...Historically, financial system rescues have involved seizing the troubled institutions and guaranteeing their debts; only after that did the government try to repackage and sell their assets. The feds took over S&Ls first, protecting their depositors, then transferred their bad assets to the RTC. The Swedes took over troubled banks, again protecting their depositors, before transferring their assets to their equivalent institutions.

The Treasury plan, by contrast, looks like an attempt to restore confidence in the financial system — that is, convince creditors of troubled institutions that everything’s OK — simply by buying assets off these institutions.

...

And there’s no quid pro quo here — nothing that gives taxpayers a stake in the upside, nothing that ensures that the money is used to stabilize the system rather than reward the undeserving.

I'm no expert, not even close. But if this crisis amounts to throwing money at otherwise technically solvent banks before they fail because they can't generate liquidity, and that phantom liquidity proceeds without reform or regulation and leads to insolvency anyway, then this bailout is just a $700 Billion golden parachute that protects only the ones who created the problem in the first place.

Grand Theft treasury

Holy fuck.

Here, give us $700 Billion without us telling you where its going, raise the legal debt ceiling to $11.3 Trillion so we don't have to bitch about it later, and make it so we can't ever talk about or be accountable for the absolute illegality of the whole thing later.

Wow. Balls.

This is, in essence, what the Iraq portion of the War On Terror became: a blatant attempt by BushCo and subsidiaries to redistribute the US Treasury among a few dozen CEO friends. They've lost everything at the poker table, but losing isn't acceptable so they're demanding that the casino repay them what they came in with, plus a little extra for the inconvenience of feeling like a loser for those five excruciating minutes they thought they might leave empty handed.

Sec. 8. Review.

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

Sec. 9. Termination of Authority.

The authorities under this Act, with the exception of authorities granted in sections 2(b)(5), 5 and 7, shall terminate two years from the date of enactment of this Act.

Sec. 10. Increase in Statutory Limit on the Public Debt.

Subsection (b) of section 3101 of title 31, United States Code, is amended by striking out the dollar limitation contained in such subsection and inserting in lieu thereof $11,315,000,000,000.

Here, give us $700 Billion without us telling you where its going, raise the legal debt ceiling to $11.3 Trillion so we don't have to bitch about it later, and make it so we can't ever talk about or be accountable for the absolute illegality of the whole thing later.

Wow. Balls.

This is, in essence, what the Iraq portion of the War On Terror became: a blatant attempt by BushCo and subsidiaries to redistribute the US Treasury among a few dozen CEO friends. They've lost everything at the poker table, but losing isn't acceptable so they're demanding that the casino repay them what they came in with, plus a little extra for the inconvenience of feeling like a loser for those five excruciating minutes they thought they might leave empty handed.

The Annotated Eschaton

klep·toc·ra·cy /[klep-tok-ruh-see] Pronunciation Key –noun, plural ‑cies. a government or state in which those in power exploit national resources and steal; rule by a thief or thieves.

--------------------------------------------------------------------------------

[Origin: 1815–20; klepto- (comb. form of Gk kléptés thief) + -cracy]

—Related forms

klep·to·crat /[klep-tuh-krat] , noun

klep·to·crat·ic /[klep-tuh-krat-ik], adjective

You're welcome.

Friday, September 19, 2008

KO Sums Up Gramps

GET OFF MY LAWN!

"The Presidential candidate said if he were in office now, he'd respond to the financial crisis by firing the chairman of the SEC... evidently not knowing the president can't fire the chairman of the SEC..."

Weekend at Benanke's

Cursor, as usual, tees up the State Of The Shitpile before taking the weekend off. Former TPMer Paul Kiel reviews the unaccountable $800 Billion Man, while Jeffrey Gundlach of TCW Group warns of No Market For Old Men and puts the ugh in ugly along the way...

In the deteriorating climate he sees unfolding, Gundlach said, the Standard & Poor's "This is no market for old-school thinking." Gundlach based his assessment on a belief that housing prices still face several more years of decline, a protracted slump, he said, not seen since the Great Depression. Moreover, Gundlach said it's possible that home prices could be sluggish until 2022.

"If it's like the Depression experience -- and it sure is shaping up that way -- it could take several years. Maybe we won't see a bottom in home prices until 2014," he said.

...

Expect loan default rates to rise, Gundlach said, not just in the subprime market, but among the top-drawer prime borrowers as well. The prime default rate could approach 10% from a current 2% before the carnage is over, he said.

"The current environment is maybe a little worse that what was experienced in the Depression in terms of the housing market," Gundlach said.